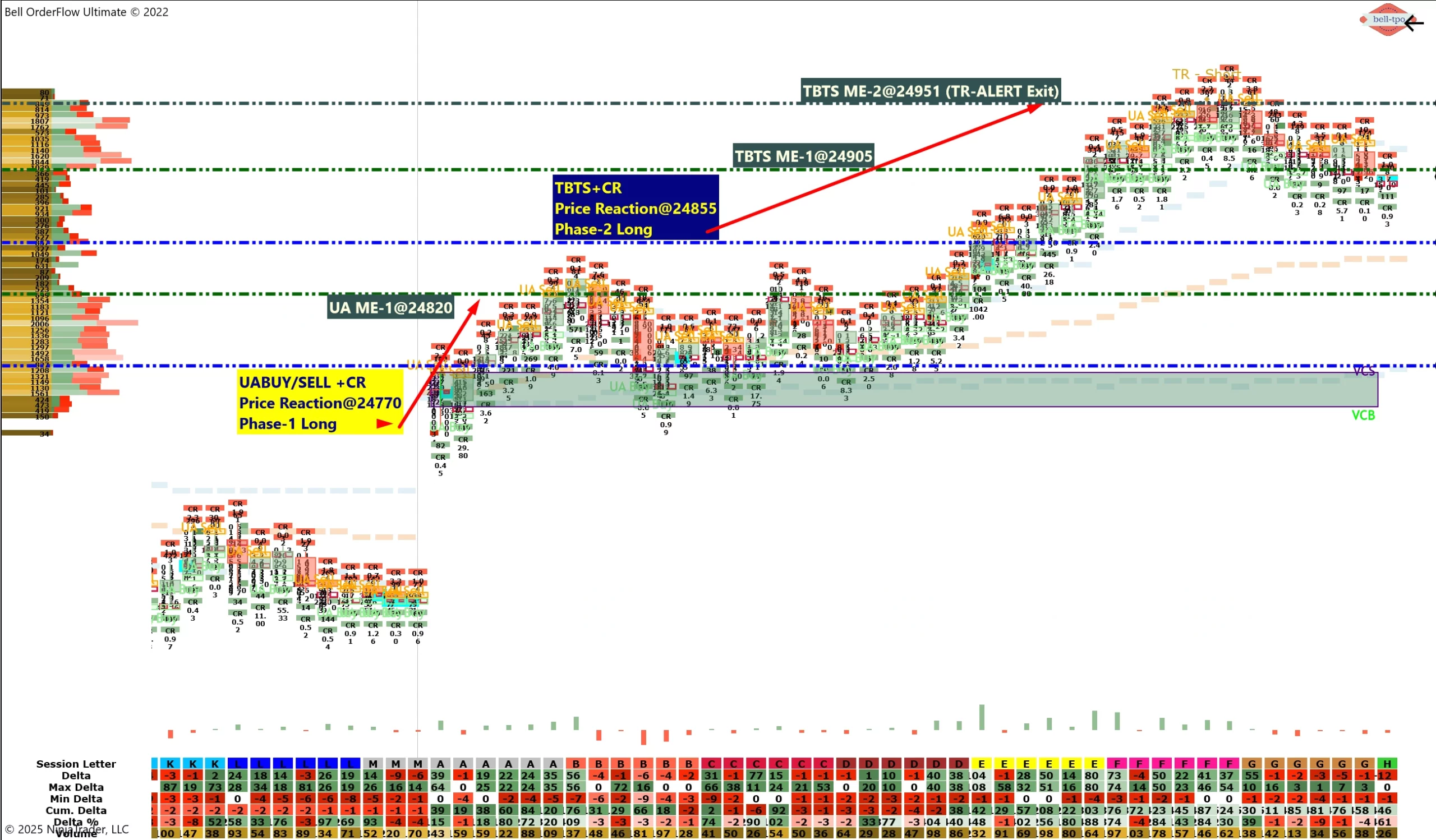

Capturing 146 Points in NIFTY_I with UA, TBTS & COT Ratio Concepts in Bell Orderflow Ultimate

In today’s NIFTY_I session, Bell Orderflow Ultimate once again proved how structured orderflow concepts can provide clarity and discipline in trading decisions. Using UA (Unfinished Auction), TBTS (Trapped Buyers/Trapped Sellers), COT Ratio, and ME (Market Equilibrium), traders had the opportunity to capture a net 146 points moves captured, with both phases developing on the long side only.

Phase-1: UA + COT Ratio Confirmation

The first phase began with UA confirmation supported by the COT Ratio at Price Reaction 24,770, progressing steadily towards UA ME-1 at 24,820.

📌 ME-1 acted as a crucial checkpoint, reflecting equilibrium shift and guiding continuation bias.Phase-2: TBTS + COT Ratio Alignment

The second phase saw TBTS (Trapped Activity) + COT Ratio confirmation at Price Reaction 24,855.- TBTS ME-1 at 24,905: Price establishing equilibrium here confirmed that trapped participants were adding pressure in favor of the trend. This level acted as a short-term balance point, reinforcing conviction to hold with the flow.

- TBTS ME-2 at 24,951: The second equilibrium level validated the strength of continuation, showing that buyers were still in control. This progression confirmed a structured path to the TR-Alert Exit, where gains could be secured objectively.

Key Educational Takeaways

- UA (Unfinished Auction): Exposed unfinished business, signaling continuation.

- TBTS (Trapped Activity): Revealed trapped participants fueling further momentum.

- COT Ratio: Added confidence by validating the strength of auction reactions.

- ME (Market Equilibrium): ME-1 & ME-2 provided progressive checkpoints within the orderflow trend.

- TR-Alert Exit: Ensured gains were protected with discipline.

Conclusion

Today’s action highlighted how UA, TBTS, COT Ratio, ME-1/ME-2, and TR-Alert Exit combine to provide structure and confidence in decision-making. With both phases aligned on the long side, traders experienced how equilibrium shifts guided directional conviction, while the TR-Alert Exit ensured disciplined closure.

For any trader serious about achieving precision and avoiding guesswork, Bell Orderflow Ultimate is more than just an indicator – it’s an edge in understanding market equilibrium and orderflow dynamics.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.