Captured 292 Points Using Bell Market Profile Ultimate + RD-Alerts

✅ Captured 292 Points Using Bell Market Profile Ultimate + RD-Alerts

SPZ rejection, secure low formation, and responsive delta signals aligning for directional move

This case study highlights how Bell Market Profile Ultimate and R-Delta Alerts helped recognize a high-probability shift in the market structure, resulting in a captured directional movement of approximately 292 points — achieved purely through auction theory, volume acceptance, and responsive behavior observation.

🔄 Why the Market Turned Higher – A Real-Time Breakdown

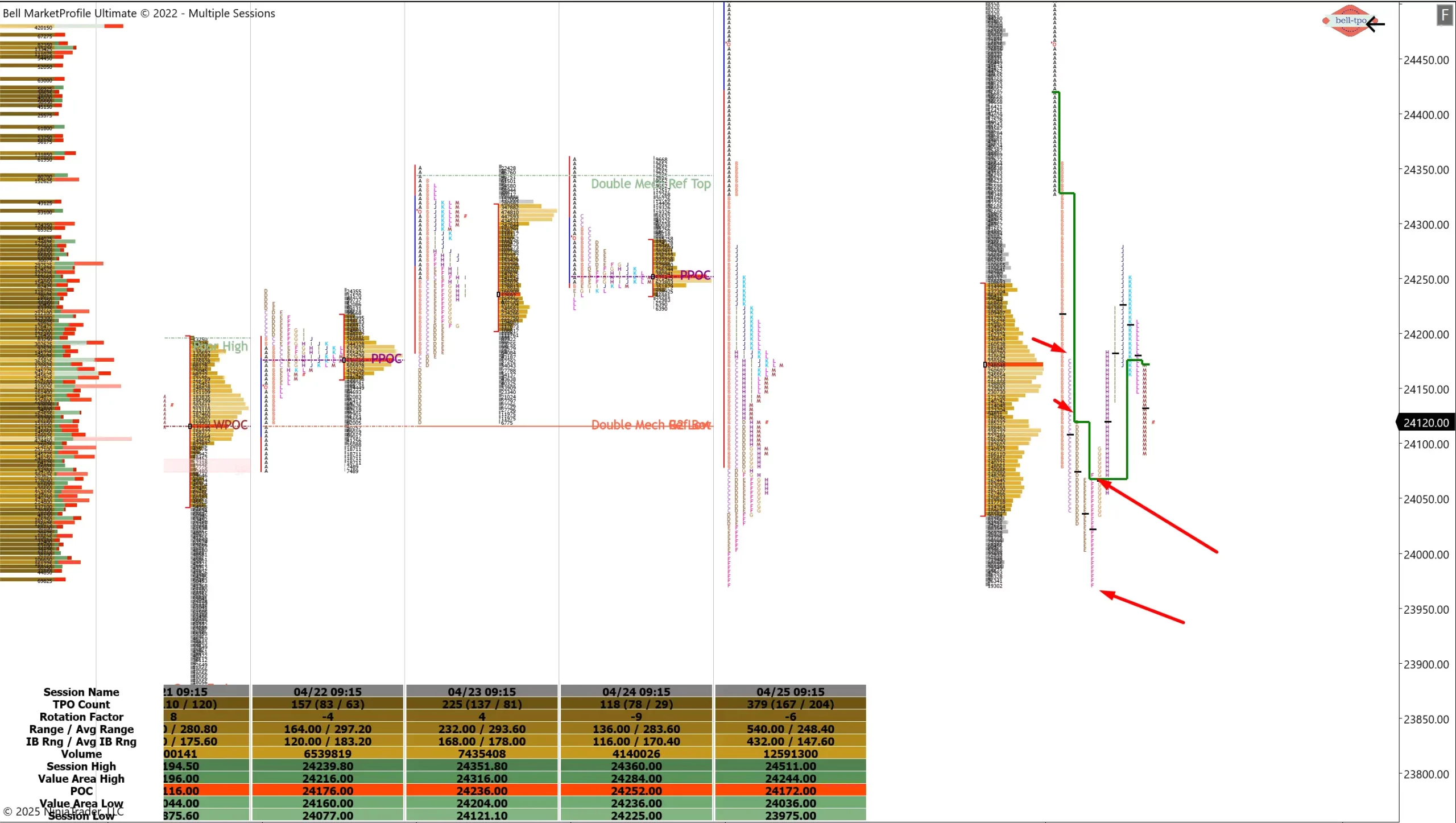

✅ 1. Single Print Zone Got Tested and Rejected

A clearly defined Single Print Zone between 24060 and 24100, originating from a prior emotional sell-off, was retested. When price revisited this area, it briefly dipped but could not sustain inside it. Responsive buying activity quickly defended the zone, signaling the market’s continued view of that area as an imbalance. This SPZ rejection triggered a shift away from the downside pressure.

🔄 2. POC Stopped Pushing Lower

Throughout the earlier decline, the Point of Control (POC) consistently migrated lower, confirming persistent seller dominance. However, as the session progressed, POC stabilized near 24020–24066, signaling a key shift: the market had paused the aggressive auction downward, showing early signs of a potential structural reversal.

🔵 3. Acceptance Developed at 24020–24066

Following the sharp liquidation, price consolidated in the 24020–24066 range, forming overlapping TPOs and higher volume nodes. This value acceptance phase suggested that the market had found temporary equilibrium, providing a platform from which responsive activity could emerge.

✅ 4. Secure Low Structure

The day’s low showed structural integrity, with clear time and volume development, rather than forming a poor low or excess wick. This overlap pattern near the base provided strong context for recognizing a Secure Low, offering responsive buyers confidence in defending these levels.

📊 Summary: Market Was Too Short → Responsive Buying Emerged

- Price revisited a known SPZ and faced rejection

- POC migration lower halted, indicating balance

- Value was established through acceptance

- A Secure Low was confirmed through overlapping TPOs and volume consolidation

These combined elements created a robust foundation for directional movement to the upside, aligning with principles taught in auction market theory.

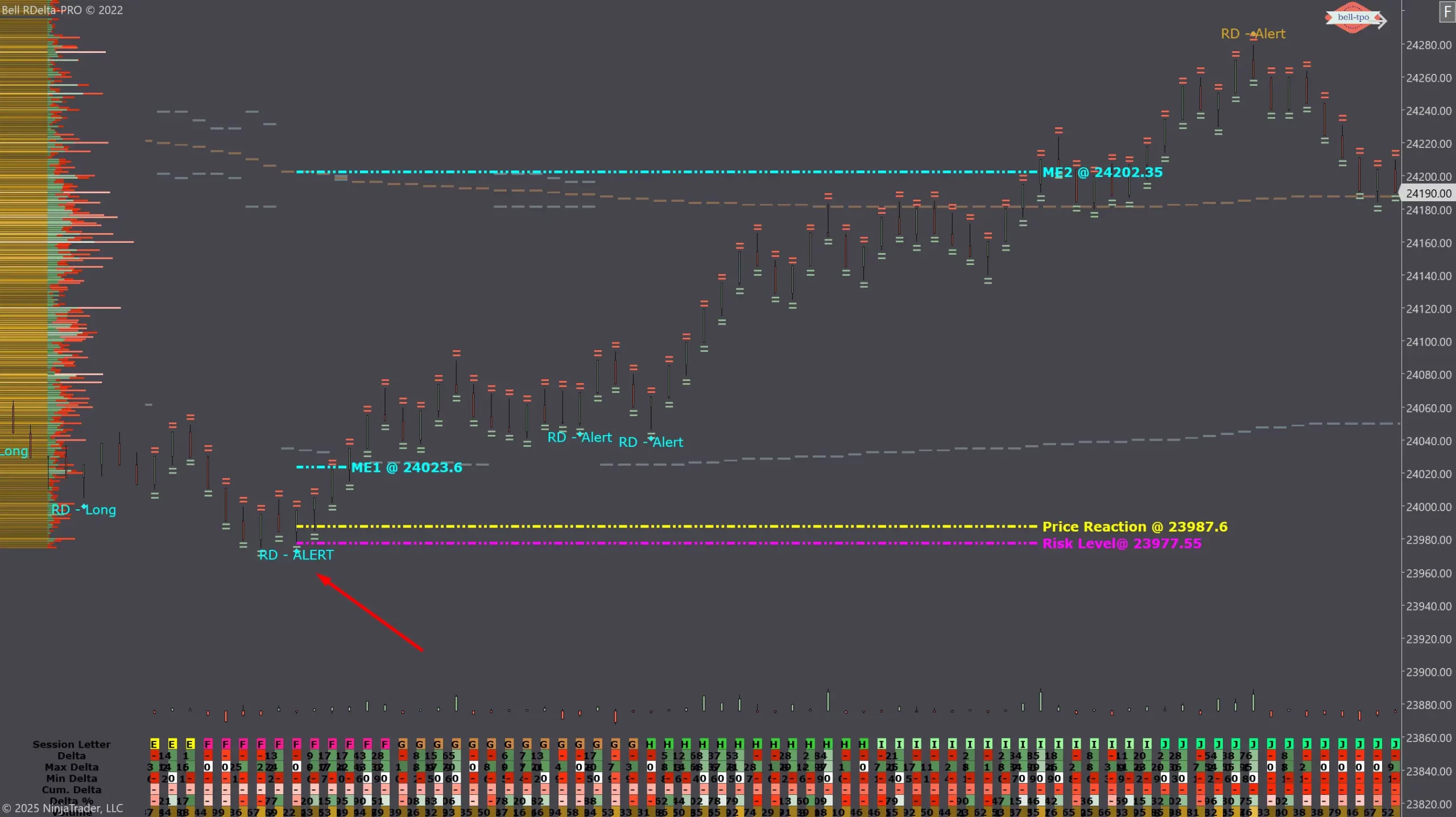

📈 Responsive Delta Confirmation with R-Delta Alerts

🔍 Responsive Delta Observations:

Near the SPZ low, R-Delta Alerts triggered, highlighting a shift where aggressive buyers began absorbing supply. These alerts, derived from cumulative delta flows and order book activity, helped confirm that the control was shifting from sellers to buyers.

🔁 Price Behavior at Key Levels:

- Price Reaction Area observed near 23987.6

- Risk Management Area maintained near 23977.55

- First Measured Move (ME-1) recognized near 24023.6

- Second Measured Move (ME-2) identified near 24202.35

These areas corresponded with balance points and previous structure, strengthening the directional thesis.

🧠 Final Takeaway:

This example captured a textbook confluence of:- SPZ Rejection ✔️

- POC Flattening ✔️

- Secure Low Formation ✔️

- R-Delta Alert Responsive Buying Confirmation ✔️

- Risk-defined approach to behavior at key levels ✔️

Disclaimer:This educational breakdown is intended solely for the purpose of explaining auction market concepts, volume profile interpretation, and delta flow observations. It is not a trade recommendation, investment advice, or a solicitation to act in the securities or derivatives market. Analysis is done with an intent to enhance understanding of market behavior using Bell Market Profile Ultimate and R-Delta tools in a professional trading framework.