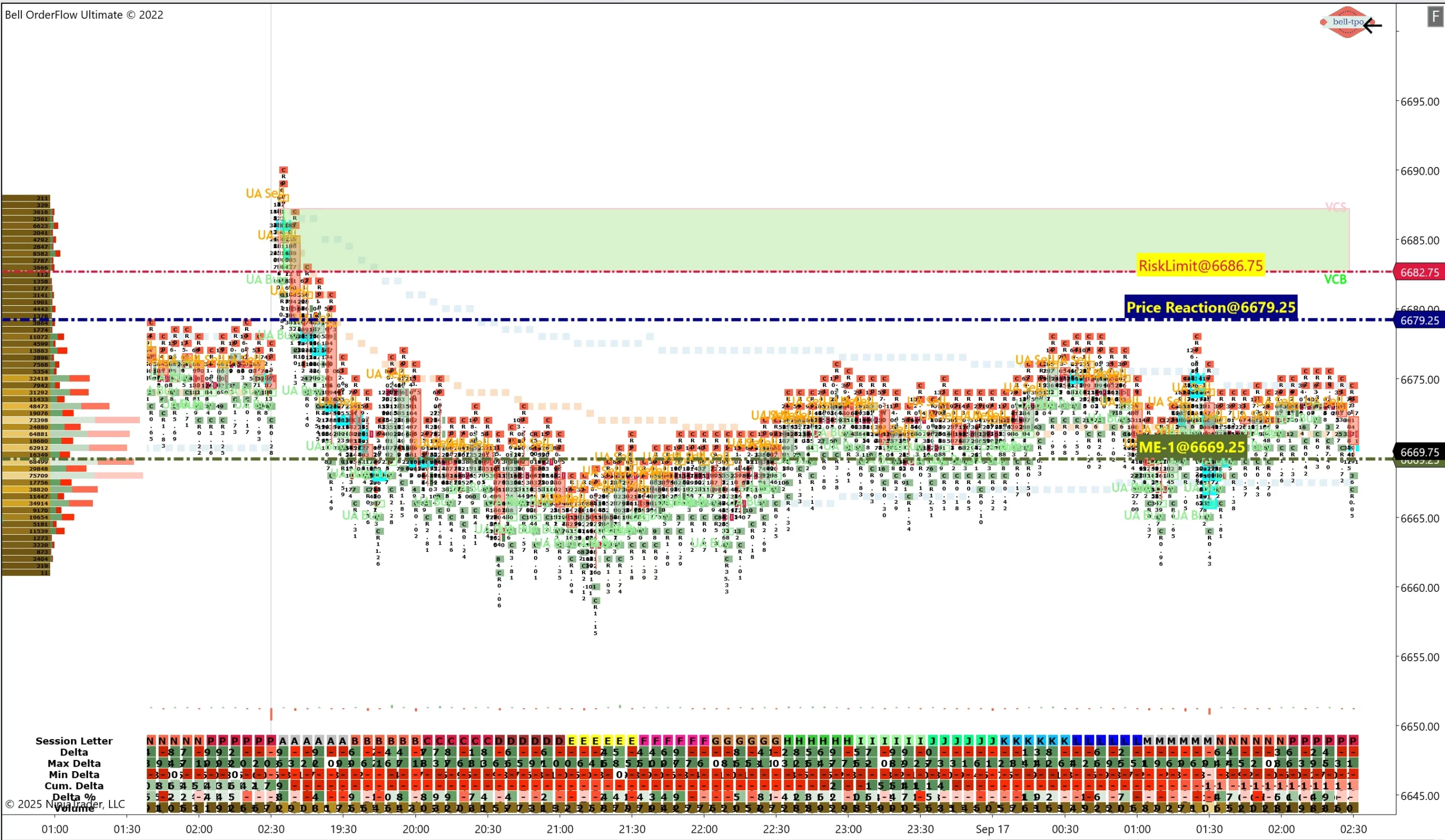

Captured 10 Points Move in ESDEC25 Using VC Zone – Bell Orderflow Ultimate(September 16)

Trading the E-mini S&P 500 (ES) futures requires precision, timing, and reliable tools. In today’s session, the VC Zone in Bell Orderflow Ultimate provided a textbook intraday setup, allowing us to capture a clean 10-point move in ESDEC25 futures.

This reinforces how powerful orderflow trading strategies can be when anchored around structured levels and predefined risk.

Key Levels in Focus

Price Reaction (PR) – 6679.25- The PR level triggered responsive buying interest right at the VC Zone.

- Buyers confirmed control, aligning perfectly with orderflow signals.

- This level served as downside containment for the session.

- Market momentum reversed before extending further, respecting ME-1.

- Defined the boundary for disciplined risk management.

- Price respected this cap, keeping the trade within safe trading limits.

Why the VC Zone is Crucial in ES Futures

The VC Zone strategy is more than just a plotted level—it represents a high-probability reference area where the market reveals its intent. When combined with Price Reaction, ME-1, and Risk Limit zones, it provides:- Clarity in volatile markets by highlighting key rotation points.

- Stronger conviction for entries and exits.

- Risk-defined trading, essential for consistent results.

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.