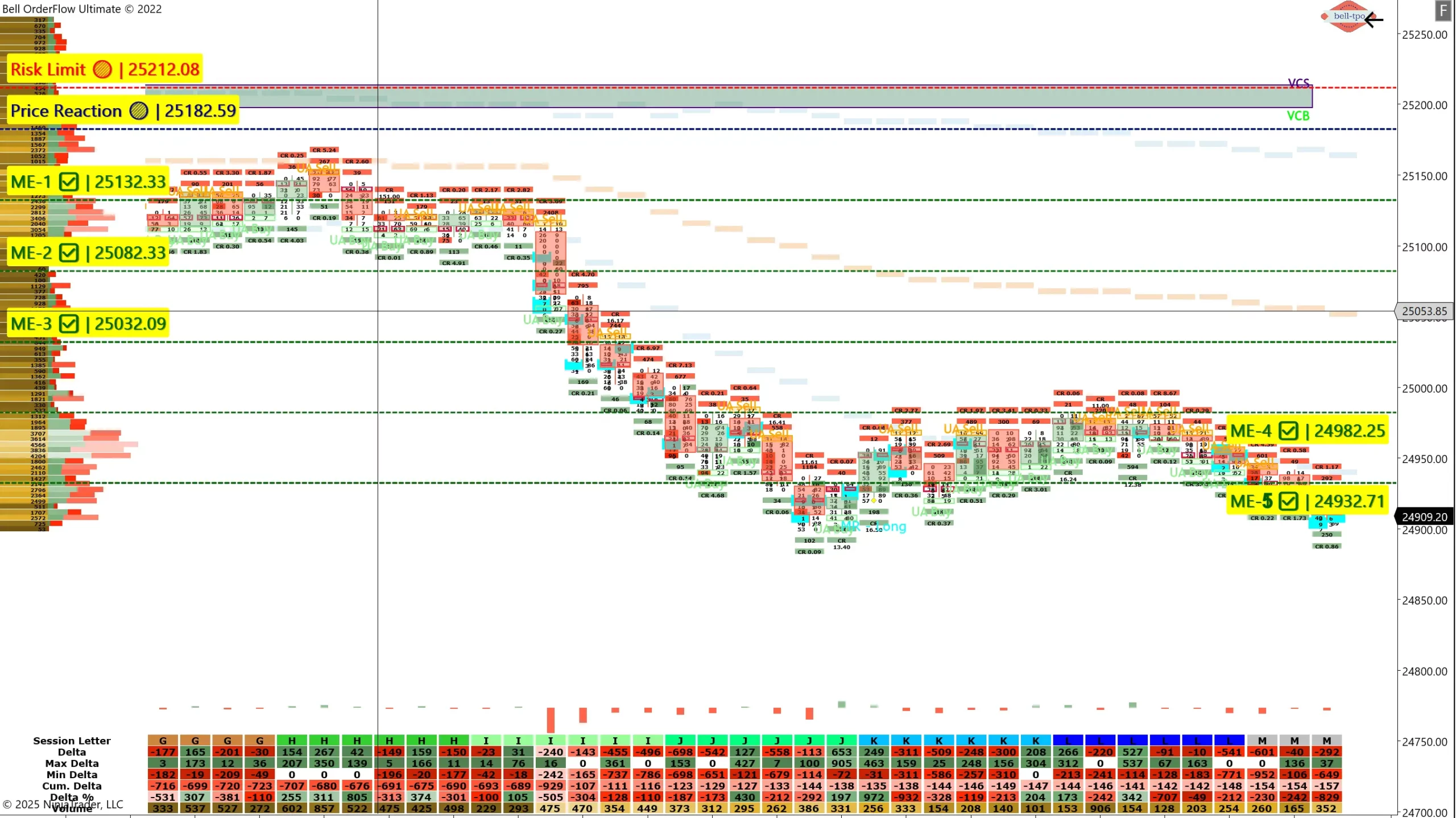

Bell Orderflow Ultimate – 250 Points Move Using VC Zone Framework

Today’s session offered a well-structured price movement driven by the VC Zone logic in Bell Orderflow Ultimate. A total move of 250 points unfolded as price reacted systematically to each Market Expectation (ME) level, offering a textbook example of contextual orderflow-based market behavior.

🔹 Price Reaction: 25182.59🔸 Risk Limit (Reference Zone): 25212.08

🔶 ME-1 @ 25132.33

The first contextual reaction came near ME-1 where price transitioned with visible orderflow activity, confirming the breakdown below the VC zone.

🔶 ME-2 @ 25082.33This level further validated the downward continuation. Price respected this zone with a steady decline and no sign of absorption from responsive buyers.

🔶 ME-3 @ 25032.09The move extended to ME-3, where minor balancing occurred, but the broader momentum continued to favor the contextual narrative of weakness.

🔶 ME-5 @ 24932.71This zone served as a terminal reference for the day’s structure. Price flow slowed here, indicating potential completion of the directional auction phase.

📊 This 250-point move is a strong example of how VC Zone with ME level references allows for structured marketunderstanding rather than random trading. It reinforces how volume and delta-based zones can guide real-time context building for intraday decisions.

📌 Note: The Bell Orderflow Ultimate tool is designed for advanced educational insights and trading analysis.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.

📎 Maximize Your Trading Edge with Bell Orderflow Ultimate Visit 👉 www.belltpo.com or reach out to us for more details.