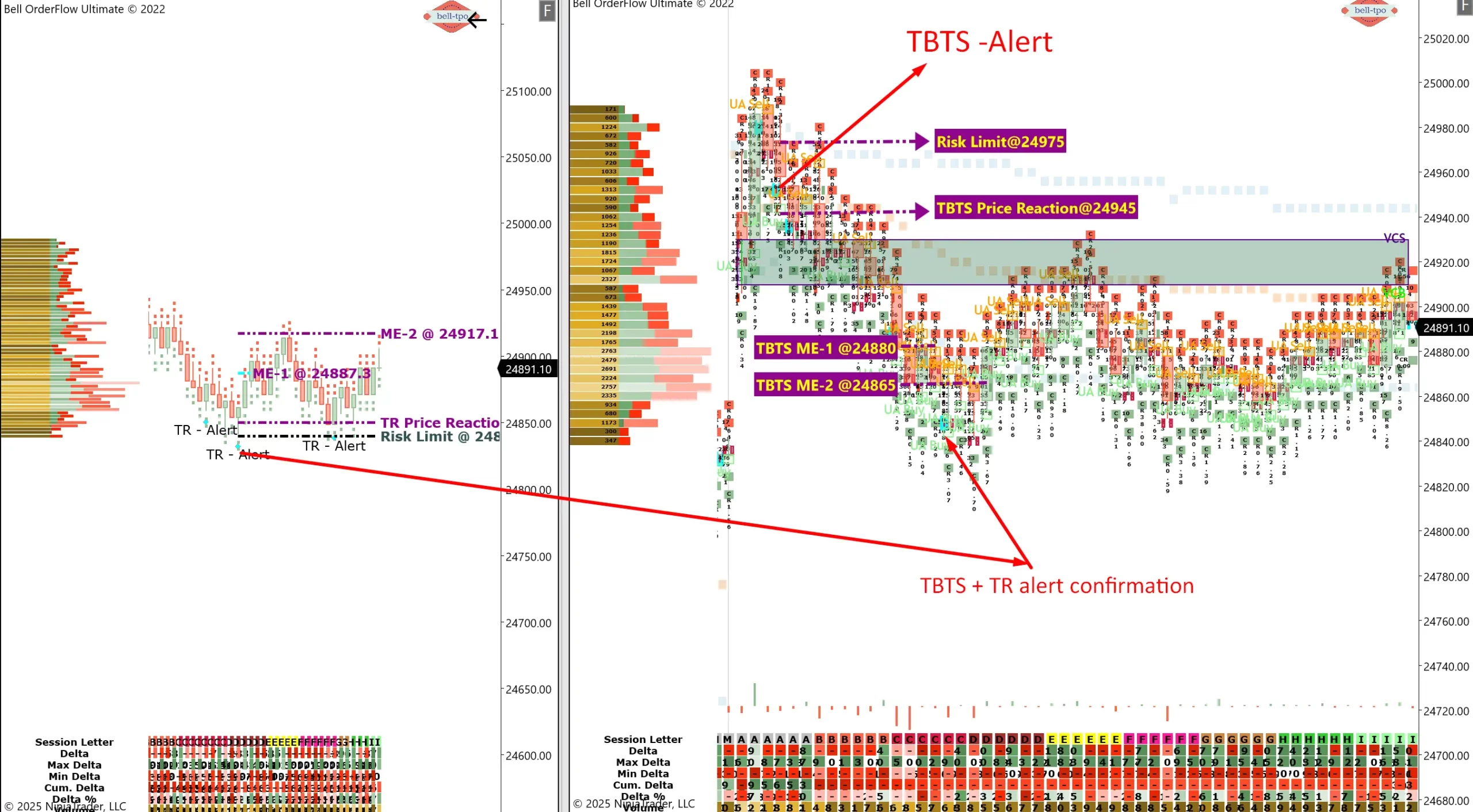

Bell Orderflow Ultimate: 117-Point Structured Move Captured with TBTS & TR-Alert Logic

Today’s market session showcased how structured orderflow logic—powered by Bell Orderflow Ultimate—can help dissect complex price behavior across multiple phases. By aligning with VC Zones, TBTS alerts, and Market Equilibrium levels, traders gain clarity through volume-driven structures rather than speculation.

🔹 Phase 1: VC-Zone Breakout Attempt

- Price Reaction @ 24970 Price attempted to break through the VC-Zone but could not sustain beyond key volume levels. This early move showed limited follow-through, indicating a lack of conviction in directional bias.

- Risk Limit @ 24940 Risk Management: The VC-Zone breakout attempt resulted in a controlled 30-point exit, guided by the predefined Risk Limit. The setup demonstrated disciplined trade handling using structured risk protocols.

🔹 Phase 2: TBTS Alert Reaction

- TBTS Price Reaction @ 24945 A sharp reversal occurred at this level, with orderflow confirming exhaustion of prior momentum. TBTS (Trend Break Through Strength) logic highlighted a shift in market control.

- ME-1 @ 24880 Price paused and reacted at this level, indicating the first major zone of volume agreement. The market showed early signs of structure forming within this band.

- ME-2 @ 24865 This deeper Market Equilibrium zone allowed the price to complete its measured move. A smooth progression through this level contributed to an 80-point structured observation.

🔹 Phase 3: TBTS + TR-Alert Confluence

- Price Reaction @ 24850 Confluence of TBTS and TR-Alert (Trend Reversal based on delta divergence) confirmed a new directional leg. This signal represented a higher-confidence reversal, supported by orderflow imbalances.

- ME-1 @ 24887 This first equilibrium checkpoint acted as a validation zone, where price showed balance before continuation. Market activity confirmed the strength of the move post-alert.

- ME-2 @ 24917 The final equilibrium level in this sequence marked the end of the move with structural completion. This phase yielded a 67-point move aligned with volume and delta-based confirmation.

🔍 Session Summary

- ✅ Phase 1: VC-Zone Breakout – Controlled Risk Exit (30 Points)

- ✅ Phase 2: TBTS Alert Move – Structured Reaction Captured (80 Points)

- ✅ Phase 3: TBTS + TR Alert Confirmation – Follow-Through Observed (67 Points)

📈 Total Structured Observation: 117 Points, tracked using Bell Orderflow Ultimate’s logic-driven framework.

This session illustrates how market flow, when read using volume concentration and reaction zones, provides a roadmap to navigate intraday volatility—far beyond conventional chart patterns or indicators.

📌 Core Concepts at Work

- VC-Zone: Volume Control Zones that mark potential breakout or rejection levels

- TBTS Alert: Detects structural imbalance and strength-based shifts in flow

- TR-Alert: Trend reversal signal based on delta divergence

- Market Equilibrium (ME) Levels: Natural volume-based checkpoints that help track price development phase by phase

📢 Disclaimer:

This blog post is for educational and informational purposes only. We are a software and indicator development company. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own analysis and seek appropriate financial advice before making trading decisions. Past performance is not indicative of future results.

🚀 Maximize Your Trading Edge with Bell Orderflow UltimateUse structured tools like VC Zones, TBTS, TR-Alerts, and Market Equilibrium levels to understand market flow in real time.

🔗 Visit: www.belltpo.com