April 8th – 250-Point Market Move Tracked Live with Bell OrderFlow Ultimate!

⚡ April 8th – 250-Point Market Move Tracked Live with Bell OrderFlow Ultimate!

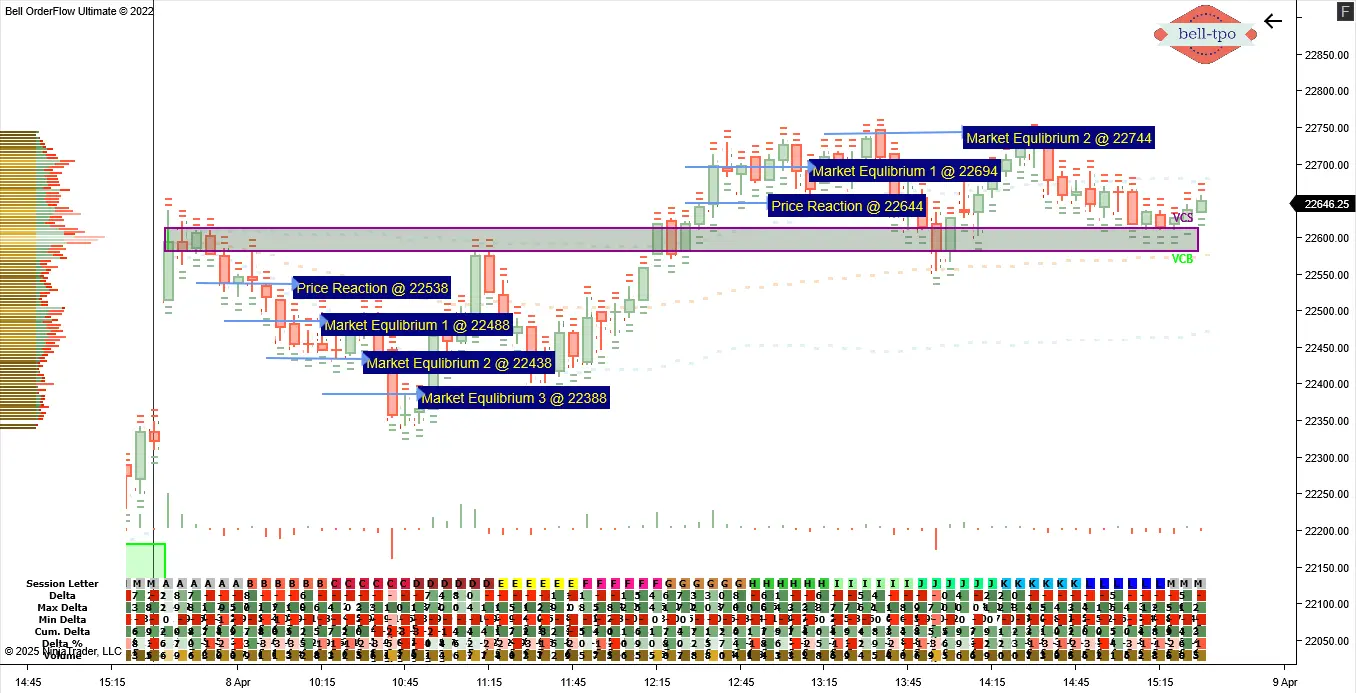

What a trading session! April 8th gave us a complete auction story – from sharp seller dominance to a solid buyer recovery – resulting in a massive 250-point market move. All of this was beautifully mapped using Bell OrderFlow Ultimate.

🧩 VC Zone + TR Alert Flip & OrderFlow Precision

The market opened near the VC Sell Zone + TR Alert, where initial resistance was clearly visible. Sellers came in aggressively at the Price Reaction level of 22538, pushing the market down to 22388, resulting in a 150-point drop.

This move wasn’t random – 🔹 Bell OrderFlow Ultimate highlighted clear Market Equilibrium shifts during the fall:- Market Equilibrium 1 @ 22488

- Market Equilibrium 2 @ 22438

- Market Equilibrium 3 @ 22388

This formed a balanced downward structure, confirming market acceptance at lower prices.

🔁 Buyer Comeback from Market Equilibrium 3

At Market Equilibrium 3 (22388), we observed:✔ Delta slowdown

✔ Absorption

✔ A structure shift

This sparked a strong buyer comeback, taking the market up to 22744, marking a 100-point recovery.

🔹 During the rally, key levels included:- Price Reaction at 22644

- Market Equilibrium 1 @ 22694

- Market Equilibrium 2 @ 22744

Buyers held control within the VC Buy Zone + TR Alert post 2:30 PM, signaling value acceptance above 22600.

🧠 Key Takeaways from Today

✅ 150-point sell-off tracked with real-time Market Equilibrium shifts✅ 100-point rally confirmed using Price Reaction zones

✅ VC Zones + TR Alerts were instrumental in identifying control shifts

✅ Bell OrderFlow Ultimate delivered clean, actionable OrderFlow insights

⚠️ Disclaimer

We are a software and indicator development company. The chart and analysis shared above are for educational and informational purposes only. They do not constitute investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Trading and investing involve substantial risk, and past performance is not indicative of future results. Please consult a certified financial advisor before acting on any information provided.