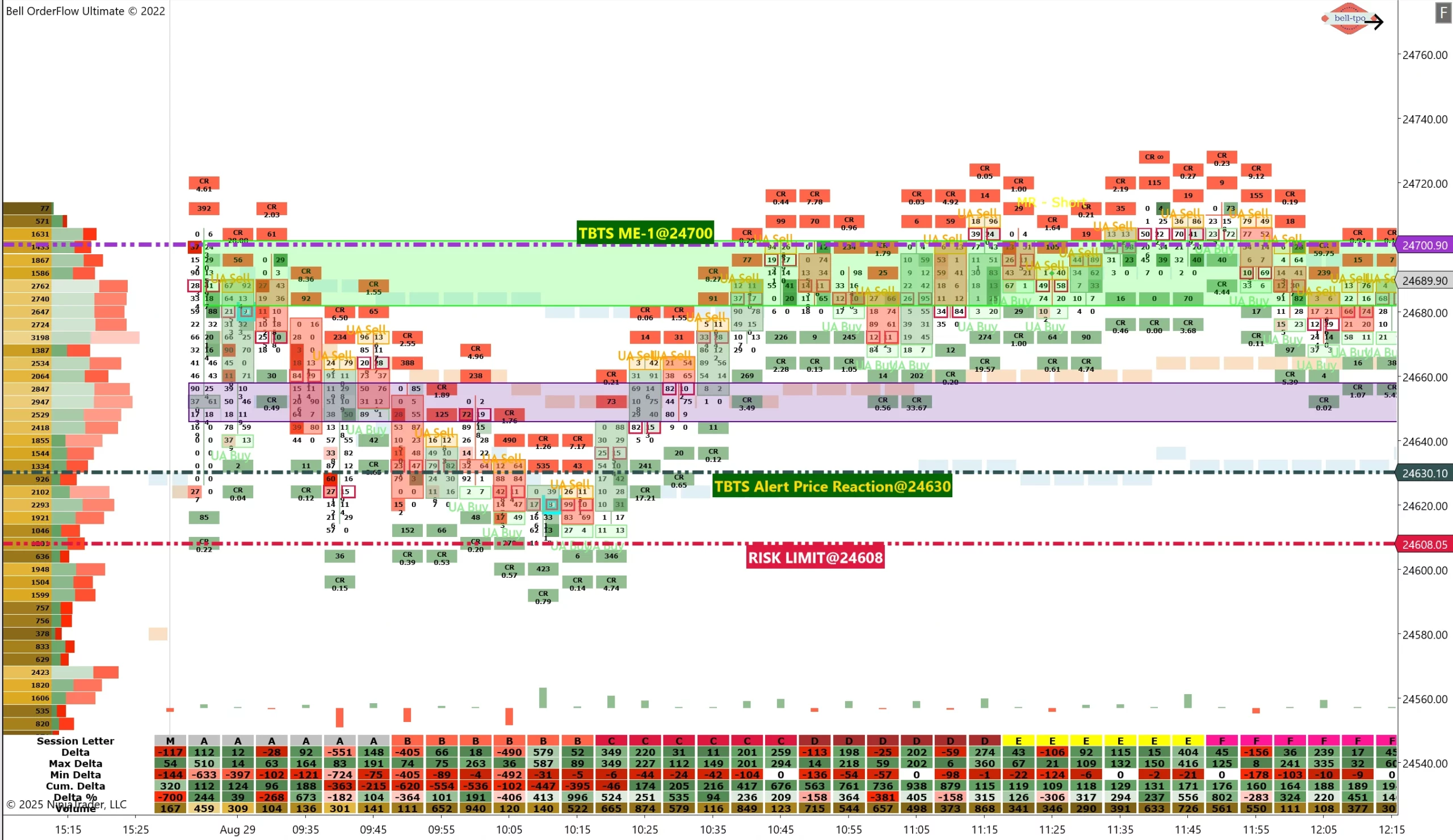

70 Points Move Captured in NIFTY_I with TBTS Alert Concept (29 Aug)

Today’s session in NIFTY_I highlighted how the TBTS alert framework in Bell Orderflow Ultimate helps traders structure their approach with clear reference points. By aligning Risk Limit, Price Reaction, and ME levels, the market move of 70 points was captured in a disciplined and transparent manner.

🔹 Risk Limit – 24608

- The Risk Limit defined the protective boundary for downside exposure.

- It ensured that participants had clarity on the maximum acceptable risk if momentum shifted.

🔹 Price Reaction – 24630

- The Price Reaction zone confirmed responsive buying activity.

- This acted as the pivot, where the market started validating the upside move.

🔹 ME Level – 24700

- The ME-1 level provided the first checkpoint of momentum continuation.

- It validated the transition from reactive activity to a structured move upward.

✅Summary: The TBTS alert concept showcased its strength today by detecting the shift in market momentum early and guiding the structured capture of a 70-point move. This reinforces how TBTS alerts bring clarity and confidence to intraday decision-making.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.