50-Points Structured Move with Bell Orderflow Ultimate

Today’s NIFTY_I session highlighted the clarity and discipline that Bell Orderflow Ultimate provides in navigating live market conditions.

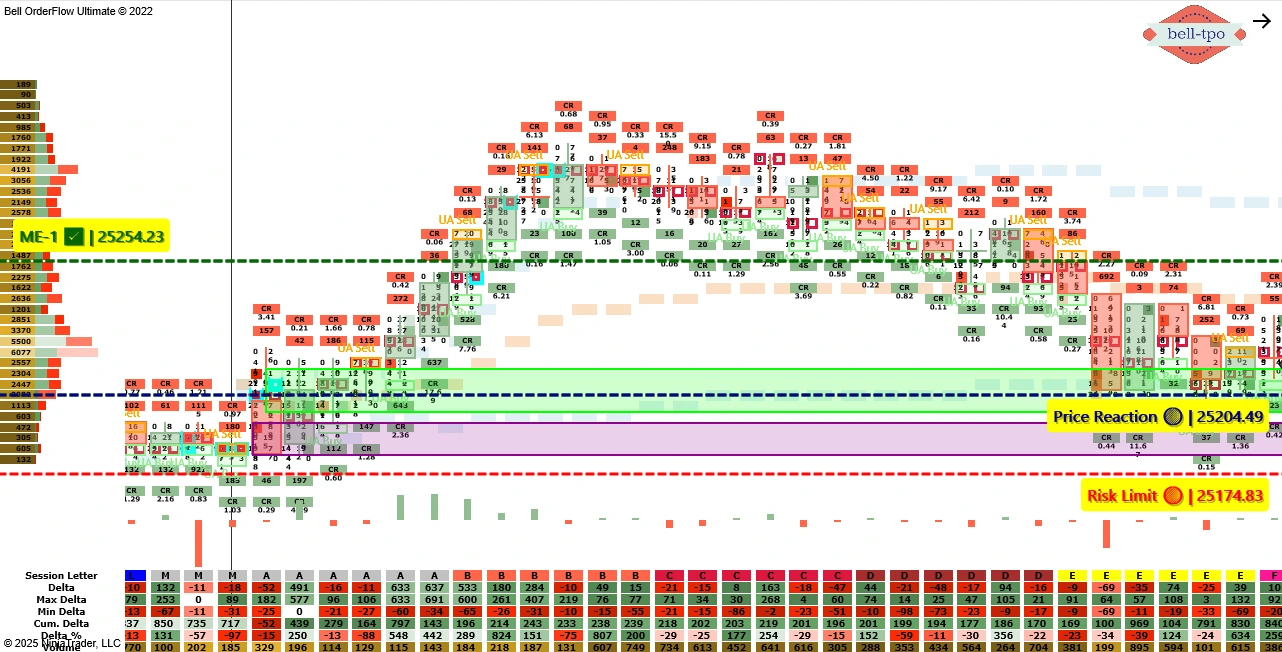

By combining VC Zone, TBTS (Trapped Buyers & Sellers), UA (Unfinished Auction), and CR (Cot Ratio) alerts, traders were guided to capture a structured 50-point move.

Price Reaction as the Turning Point

The session kicked off with a decisive Price Reaction @ 25204.49, which became the foundation for directional conviction.- It marked the initial shift in auction pressure, signaling that buyers were stepping in at a critical reference point.

- Sustaining above this reaction confirmed that the market bias had tilted in favor of the long side.

- It helped to maintain focus on the upside as long as the market held above this level.

- This clear reference minimized emotional decision-making by establishing a precise invalidation point.

Progressive Momentum: Role of ME Levels

The rally unfolded in a structured and stepwise manner, guided by ME levels.- ME-1 @ 25254.52 → Marked the first equilibrium checkpoint, validating the continuation strength after the Price Reaction. It provided traders with confidence to stay aligned with the unfolding move.

Strength of Alerts Behind the Move

The success of today’s move was anchored in real-time alerts that identified both the intent and strength of market participants:- VC Zone Alerts → Identified the core value area, where the auction flow shifted in favor of buyers.

- TBTS Alerts → Highlighted trapped sellers, confirming that their exit pressure was driving the move higher.

- UA Alerts → Indicated areas of unfinished auction, signaling that the rally had further participation left.

- CR (Cot Ratio) Alerts → Provided confirmation of continuation strength, reinforcing confidence in staying with the trend.

Net Outcome

The session demonstrated that alerts combined with structural references like Price Reactions, Risk Limits, and ME Levels help traders approach the market with discipline and precision.✅ Total Gain: A clean 50-point structured move in NIFTY_I, guided by Bell Orderflow Ultimate.

Key Takeaways

- Alerts such as VC Zone, TBTS, UA, and CR help traders identify momentum early and confirm its continuation.

- Price Reaction and Risk Limit provide the foundation for disciplined entries and directional conviction.

- ME Levels guide traders step by step, offering clarity during the move.

This session reaffirmed that the combination of alerts and structured market references transforms market data into a clear, actionable framework.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com to explore how our alert-focused tools help traders capture opportunities with clarity and discipline.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making any trading or investment decisions.

Past performance is not indicative of future results.