50 Points Structured Move in NIFTY_I with Bell Orderflow Ultimate

Educational Insight

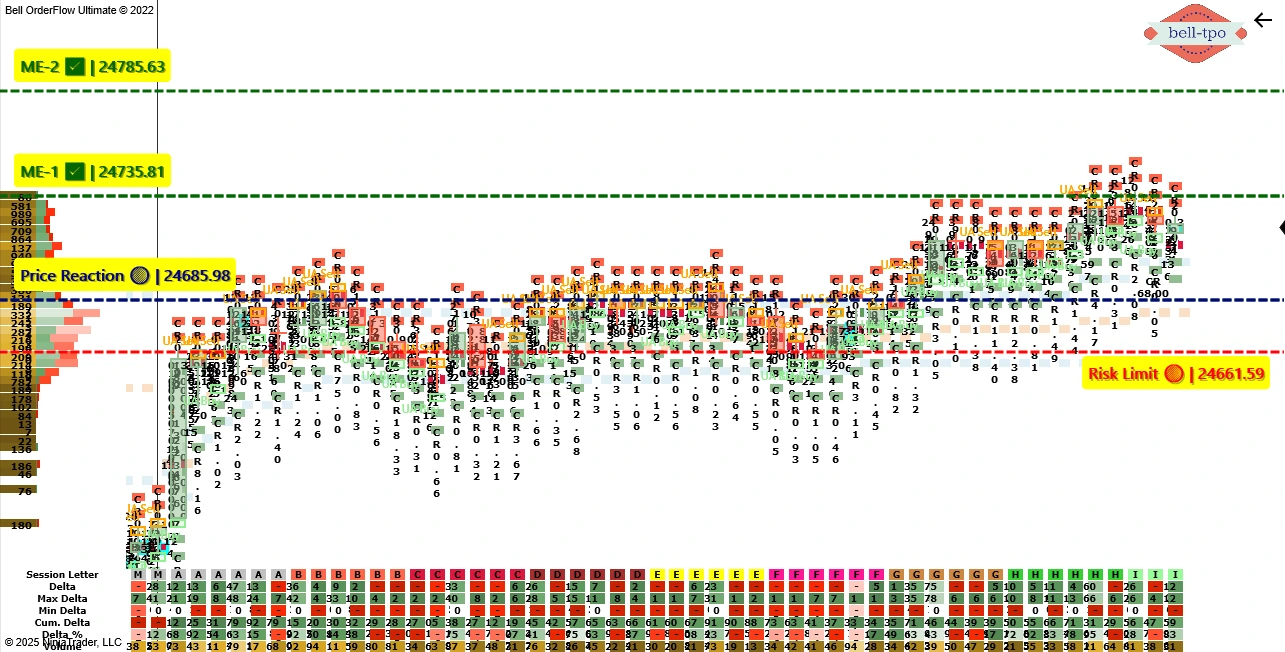

Today’s chart illustrates how structured references like Risk Limit, Price Reaction, and ME levels combined with TBTS & UA concepts can guide market understanding. This is not trading advice but a demonstration of systematic orderflow mapping.

Key Reference Levels

- Risk Limit @ 24661.59 Served as the protective boundary, defining the risk framework and anchoring downside clarity.

- Price Reaction @ 24685.98 Marked the first strong response from buyers, highlighting the turning point where momentum started shifting.

- ME-1 @ 24735.81 Provided a step in the continuation ladder, ensuring disciplined tracking as the move unfolded.

Session Outcome

- A 50-point structured move was observed in NIFTY_I. The combined strength of TBTS (Trapped Activity) and UA validated orderflow shifts, showing how the Bell Orderflow Ultimate reduces manual workload and provides clarity in volatile conditions.

- This example reinforces the importance of working with defined references instead of speculation, helping traders approach the market with discipline and confidence.

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.