45 Points Structured Move in ES Mini with Bell OrderFlow Ultimate

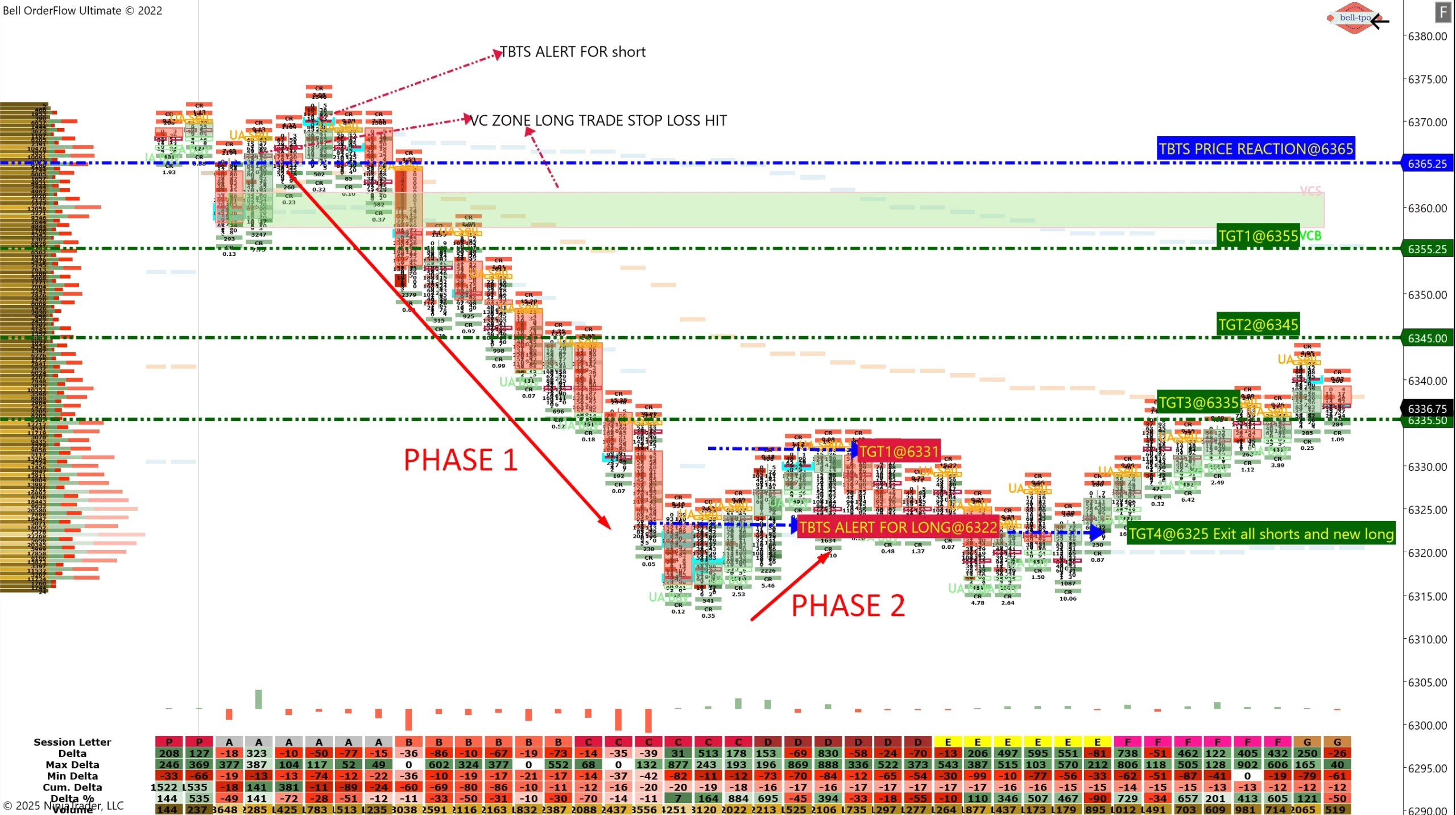

Today’s ES Mini session showcased a classic two-phase move identified through VC Zone and TBTS Alerts in Bell OrderFlow Ultimate. Even after a 5-point risk limit hit early in the day, the structured approach allowed the capture of 45 net points through sequential market phases.

Phase 1 – Short Setup

- Setup Confirmation: TBTS Alert indicated a potential short entry.

- Entry Level: 6365

- Price Reaction: Initial move towards the first target zone at 6355.

- Risk Limit: Managed to protect downside exposure with predefined point-based limits.

- Progression: Targets at 6355, 6345, 6335, and 6325 were reached sequentially.

- Exit: All short positions closed before transitioning to the next phase.

Phase 2 – Long Setup

- Setup Confirmation: TBTS Alert breakout at session lows indicated a reversal opportunity.

- Entry Level: 6322

- Price Reaction: Swift momentum push towards 6331, meeting the initial move objective.

- Outcome: Efficient capture of the reversal leg while maintaining structured execution.

Key Takeaway

This session demonstrates the importance of structured market phase analysis using Bell OrderFlow Ultimate. By following pre-defined risk limits and reacting to live alerts, traders can adapt quickly when market direction changes, ensuring they capture opportunities across both trend and reversal setups.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.