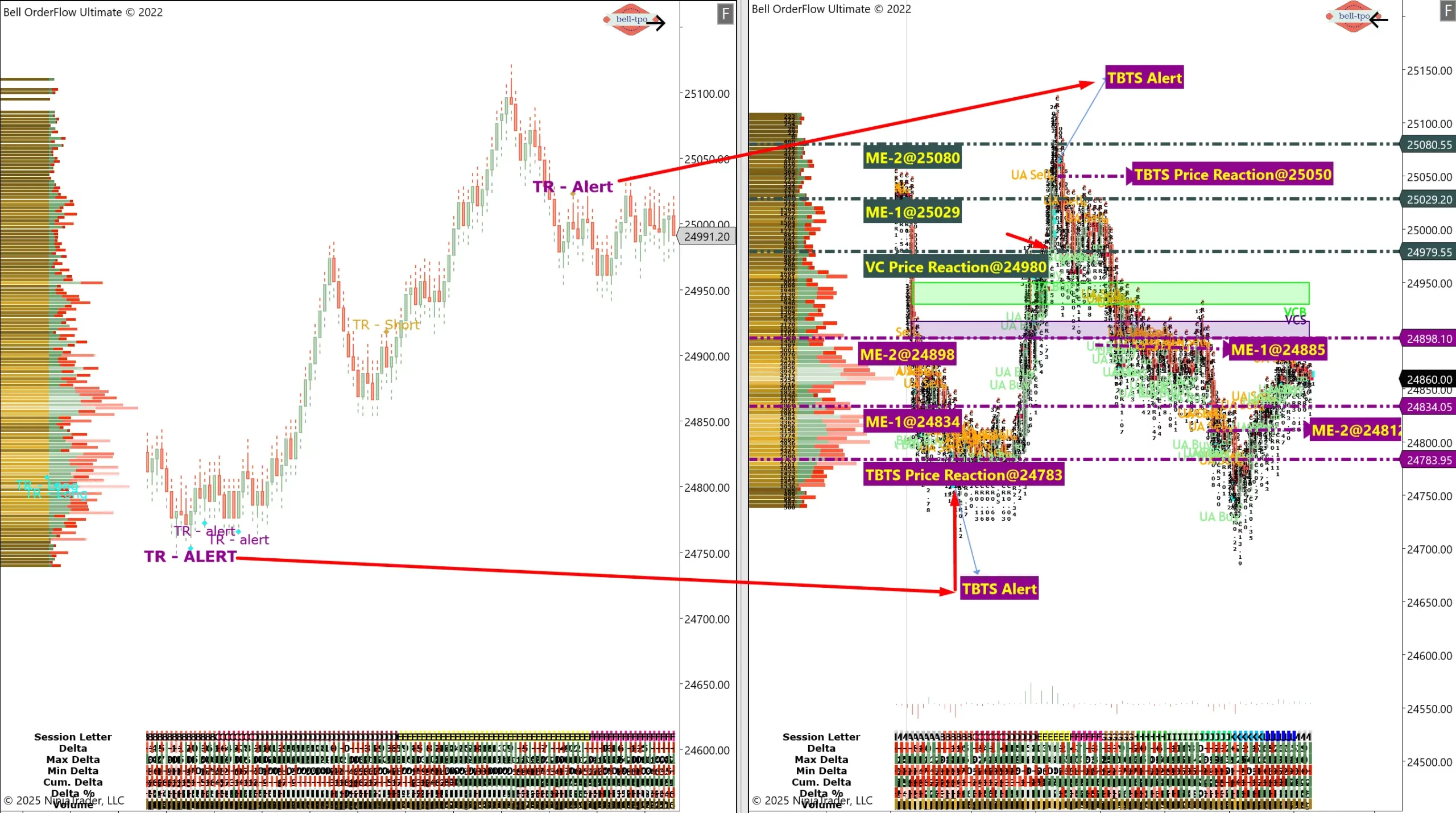

445-Point Structured Move Captured Using TBTS Alerts, VC-Zone, and ME Levels

Today’s trading session in NIFTY_I unfolded through three well-defined phases, each supported by Bell Orderflow Ultimate’s advanced logic. With a combination of TBTS Alerts, VC-Zone Breakout, and TR-Alerts, the session offered an exceptional opportunity to study price behavior across Market Equilibrium levels (ME).

🔵 Phase 1: TBTS Long Setup from Day’s Low – 115 Points Captured

🟣 TBTS Alert was triggered at Price Reaction @ 24783, aligning with a TR-Alert (Trend Reversal alert) based on delta divergence — a concept widely used in orderflow to anticipate directional change.

🔹 ME-1 @ 24834 and ME-2 @ 24898 acted as structural resistance turned support during the up-move. Price respected both zones before proceeding higher.

🟢 Phase 2: VC-Zone Breakout – 110 Points Captured

📗 A confirmed breakout from VC-Zone @ 24980 initiated the second leg of the move. Volume consolidation above this zone indicated strong buyer intent.

🔹 ME-1 @ 25029 and ME-2 @ 25080 were tested as price moved higher, showing effective reaction at each equilibrium level. These ME zones served as short-term resistance before reversal.

🔴 Phase 3: TBTS Short Setup from Day’s High – 230 Points Captured

🟣 A reversal began with a fresh TBTS Alert and supporting TR-Alert at Price Reaction @ 25050, near the session high.

🔹 The decline was guided through ME-1 @ 24885 and ME-2 @ 24812, both of which acted as transition zones during the downtrend. Price showed clear volume-based rejection at these ME levels.

🧠 Educational Insights:

- TBTS Alert (Trap Breakout & Trap Setup): Indicates potential reversal after absorption/trap volume logic is detected.

- TR-Alert: Trend Reversal alert formed at both day’s bottom and top, strengthening TBTS setups. It is based on delta divergence, a trusted orderflow concept to detect early reversal signs.

- Market Equilibrium Levels (ME): Acted as key validation checkpoints for each leg of the move, allowing structure-based assessment instead of emotional entries.

📊 Maximize Your Trading Edge with Bell Orderflow Ultimate

Explore the structured logic of volume and delta-based setups at 👉 www.belltpo.com

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.