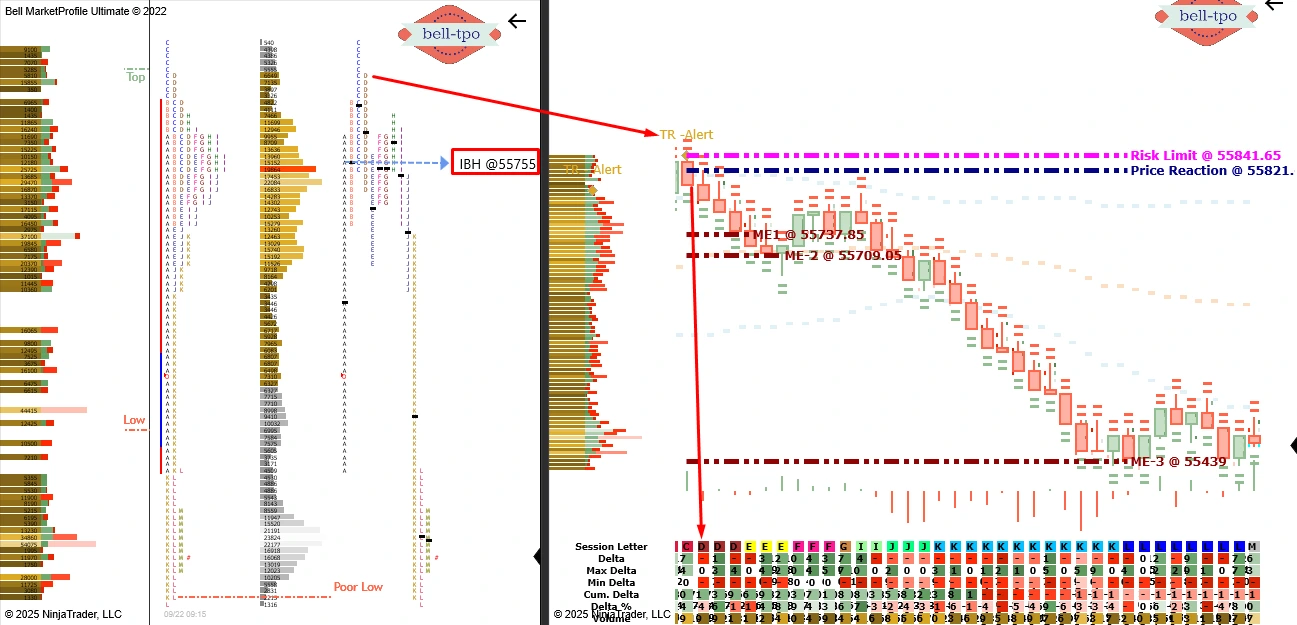

382 Points Move Highlighted in BANKNIFTY_I Using TR-Alert in Bell orderflow Ultimate & IBH concept in Bell Market Profile Ultimate

Today’s analysis showcased how a combined effort of Bell Market Profile Ultimate and Bell Orderflow Ultimate can help traders identify meaningful reference points. In BANKNIFTY_I, a structured move of 382 points unfolded, offering a clear educational example of how references and alerts work together in real-time market study.

Bell Market Profile – IBH Reference

In Bell Market Profile Ultimate, the Initial Balance High (IBH) condition was met. IBH often acts as a critical reference level in intraday trading, as markets tend to revisit or test these zones during the session. Observing this reference helps traders understand whether the auction is sustaining above or showing signs of rejection at higher levels.

Bell orderflow Ultimate – TR Alert

On the Bell Orderflow Ultimate side, a TR Alert (Trend Reversal) was triggered. TR Alert is based on the principle of delta divergence, where orderflow shows weakening pressure despite price attempting to push further. This often signals a shift in momentum, providing an added layer of confirmation.

Understanding Market Equilibrium (ME)

Market Equilibrium (ME) is a concept where buyers and sellers temporarily agree on price, creating balance zones during the auction process. These levels help identify where the market is likely to pause, consolidate, or reassess before continuing its move. Tracking ME levels adds structure to intraday observation, showing how far the auction travels before balance is restored.

Key Reference Levels

- Risk Limit @ 55841.65 The Risk Limit is the outer control zone where the auction is expected to stay contained. A breach beyond this point indicates imbalance and potential excess in market activity.

- Price Reaction @ 55821 The Price Reaction level reflects where the market first responded with visible activity. It is an early signpost that shows whether participants are defending or rejecting that zone.

- ME-1 @ 55737.85 Market Equilibrium 1 represents the first balancing point in the auction process. It signals where short-term buyers and sellers attempt to find temporary agreement.

- ME-2 @ 55709.05 Market Equilibrium 2 marks a deeper balancing area as orderflow continues to test range. Observing activity here helps gauge whether the market is still searching for fair value.

- ME-3 @ 55439 Market Equilibrium 3 is the final balance reference for the session’s structure. When tested, it shows how far the market had to travel before reaching a stable consensus.

Why Combining Both Matters?

When Market Profile references like IBH are paired with Orderflow-based TR Alerts, the analysis becomes more powerful. Market Profile provides structural balance zones, while Orderflow validates them with live buying and selling strength. This dual confirmation helps in reading the auction process with greater clarity.

The educational takeaway here is simple: market structure plus orderflow confirmation can filter noise and highlight more reliable setups.

✅ Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.