325-Point Structured Move Captured with Bell Orderflow Ultimate

Today’s market session offered a high-probability trading opportunity using structured logic built into Bell Orderflow Ultimate. By applying VC-Zone, TR-Alert, and TBTS Alert concepts, traders could interpret market phases with greater clarity and manage trades within defined zones and limits — without relying on random signals.

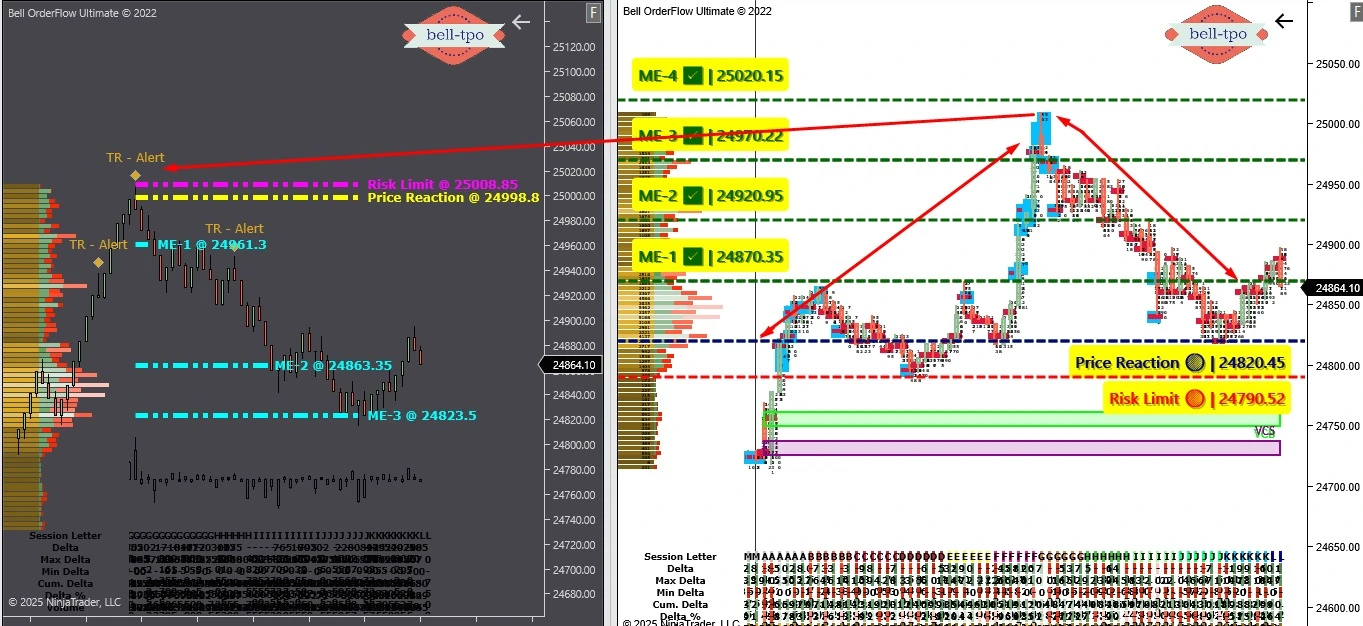

🔹 Phase 1: VC-Zone Guided Move – 150 Points Captured (Upside)

The first half of the session was guided by a VC-Zone setup, highlighting an opportunity for structured directional bias from the lower band.

- Price Reaction @ 24820.45 Initial buyer activity emerged, indicating an area where demand began asserting control.

- Risk Limit @ 24790.52 Defined the boundary for acceptable risk in case of downward continuation; the market stayed safely above.

- ME-1 @ 24870.35 This level validated the initial up-move with a responsive flow of buyers.

- ME-2 @ 24920.95 Showed continuation strength with no signs of significant seller rejection.

- ME-3 @ 24970.22 Represented a moment of strong momentum, and a potential exhaustion zone where volume thinned out.

This sequence resulted in a well-structured 150-point move from the VC-Zone with real-time logic aiding in directional conviction.

🔸 Phase 2: TR-Alert & TBTS Alert Confirmation – 175 Points Captured (Downside)

The second half witnessed back-to-back TR-Alerts confirmed by TBTS, showcasing the importance of volume imbalance and delta divergence logic.

✅ Alert Summary:

- TR-Alert (Trend Reversal Alert) marks potential exhaustion of trend based on aggressive delta shifts.

- TBTS Alert (Trend Breakdown Trigger ) confirms structural rejection using real-time order flow pressure.

⚠️ Initial Trigger (No Follow-through)

- The first alert set failed to develop, and the price moved above the Risk Limit, indicating structural invalidation.

✅ Subsequent Scenario (Volume Shift Aligned with Downward Move)

- Price Reaction @ 24998.80 Strong responsive seller activity appeared here, halting the uptrend and initiating the reversal.

- Risk Limit @ 25008.85 Provided a clear invalidation point — respected without breach.

- ME-1 @ 24961.30 Indicated early confirmation of downward shift with lower high rejection.

- ME-2 @ 24863.35 Continued downside with no support buildup; showed momentum in favor of sellers.

- ME-3 @ 24823.50 Final structure before consolidation; price stalled here, completing the leg.

This phase completed a 175-point move, showcasing how dual-confirmation (TR + TBTS) enhances confidence in volume-based setups.

📚 Key Learning Points:

- VC-Zone helps define structured entries with tight risk zones and multi-level Market Equilibrium logic.

- TR-Alert offers early indication of trend exhaustion based on delta dynamics.

- TBTS Alert acts as a confirmation layer to filter higher-confidence reversals.

- ME Levels (Market Equilibrium) serve as decision checkpoints — not targets — helping manage position strength and risk tolerance.

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.