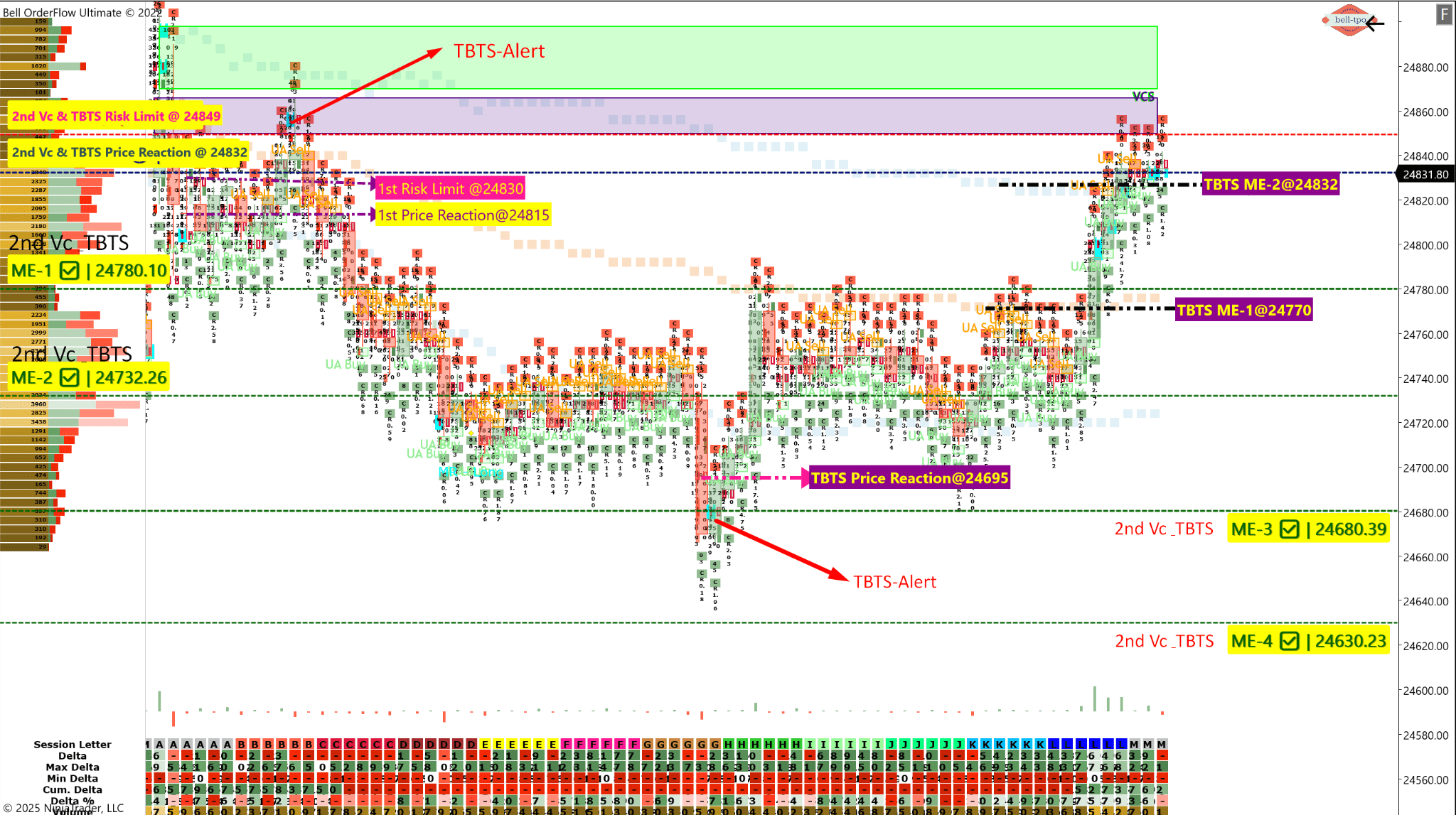

257-Point Structured Move Captured Using Bell Orderflow Ultimate

Today’s market action delivered a total structured move of 257 points, combining contextual VC-Zone breakdowns and TBTS alerts. Each phase was guided by Price Reaction zones, Risk Limits, and Market Equilibrium (ME) levels — offering a clear, volume-driven roadmap for decision-making.

🔹 Phase 1: Initial VC-Zone Breakdown – Controlled Risk Exit (30 Points Loss)

- Price Reaction @ 24815 🔸 Initial attempt to break VC-Zone saw a sharp reaction at 24815, indicating early seller interest. 🔸 However, price failed to sustain and reversed above the risk limit, invalidating the breakdown setup.

- Risk Limit @ 24830 🔸 Price closed above this level post-breakdown, signaling failure of the bearish continuation. 🔸 Serves as a key threshold for risk-managed exits during low-confidence setups.

💡 This phase ended with a disciplined 30-point controlled exit, showing the importance of predefined risk zones in volatile environments.

🔹 Phase 2: VC-Zone Breakdown + TBTS Alert – 150 Points Move

- Price Reaction @ 24832 🔸 Confirmed the VC-Zone breakdown along with TBTS, initiating strong downside momentum. 🔸 Acted as the structural turning point validating aggressive sellers.

- Risk Limit @ 24849 🔸 A well-defined ceiling beyond which bearish breakdown would be invalidated. 🔸 The move stayed well below this level, confirming breakdown reliability.

- ME-1 @ 24780 🔸 First support level that was breached with momentum after the breakdown. 🔸 Marked early acceptance of lower prices and trend continuation.

- ME-2 @ 24732 🔸 Consolidation and brief volume absorption were observed here before further drop. 🔸 Its failure confirmed strength in the directional move.

- ME-3 @ 24680 🔸 Final support zone where sellers showed exhaustion and price paused. 🔸 Formed the base before the reversal was initiated.

✅ This phase captured a 150-point move, fully aligned with TBTS trap logic and structural breakdown through all three ME levels.

🔹 Phase 3: TBTS Alert Reversal from Day’s Bottom – 137 Points Move

- TBTS Price Reaction @ 24695 🔸 Marked the lowest point where buying pressure reappeared after heavy selling. 🔸 TBTS Alert confirmed the trap of late sellers, initiating a sharp upside reversal.

- ME-1 @ 24770 🔸 Price reclaimed this level quickly, signaling momentum on the long side. 🔸 Also served as a structural confirmation for ongoing recovery.

- ME-2 @ 24832 🔸 Retest of the original breakdown zone from Phase 2. 🔸 Successfully reclaimed, completing the reversal leg and confirming strength.

📈 This reversal phase contributed 137 points, supported by orderflow-based trap recognition and smooth transitions across ME levels.

✅ Total Captured Move: 257 Points (Net of All Phases)

- VC-Zone Breakdown + TBTS Combo: 150 Points

- TBTS Alert Reversal: 137 Points

- Initial Failed Setup: -30 Points Controlled Risk

📚 Educational Insight

The Bell Orderflow Ultimate framework combines real-time volume delta analysis with contextual tools like VC-Zones, TBTS Alerts, and ME levels. This approach removes subjectivity by using structure and flow to interpret market behavior — not predictions or fixed signals.

🌐 Learn more: www.belltpo.com

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.