210-Point Market Move: Price Reaction, VIX & VC Zone Alert in ESJUN25

210-Point Market Move: Price Reaction, VIX & VC Zone Alert in ESJUN25

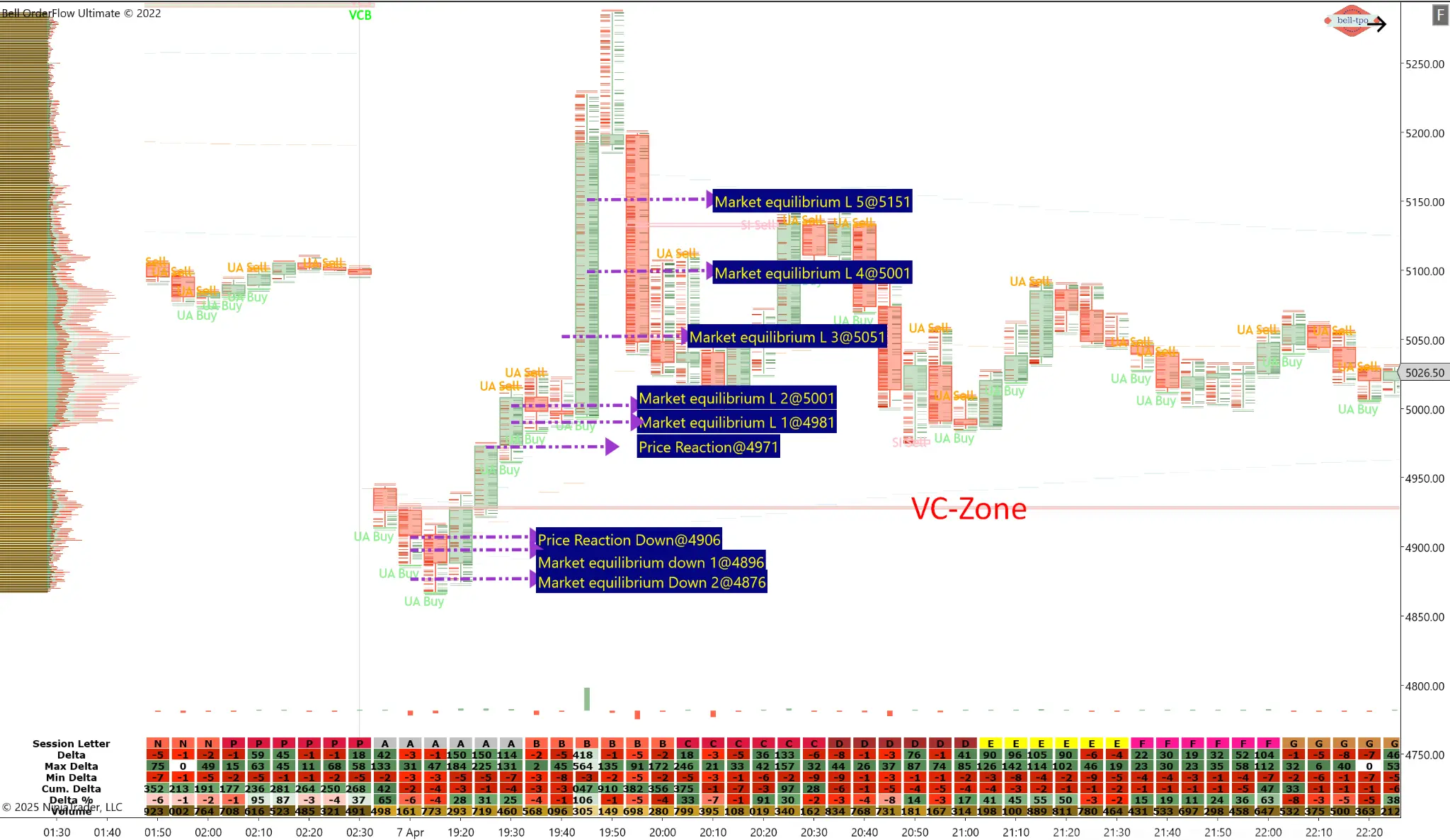

Today’s session in ESJUN25 presented a dynamic and fast-moving market, with 210 points captured within the first 45 minutes. Both upside and downside moves were captured following key Price Reactions, Market Equilibrium levels, and strategic use of the VC Zone. Bell Orderflow Ultimate enabled precision in navigating these rapid moves, thanks to volume-based analysis and adaptive market equilibrium adjustments.

Key Market Developments & Observations

📌 Price Reaction Down @ 4906The session opened with a significant Price Reaction Down @ 4906, marking the first notable breakdown below the VC Zone. The strong selling pressure triggered by this reaction provided a clear signal to capture the initial move down.

📌 Breakout Below VC Zone with VolumeAs the market broke below the VC Zone, we observed a notable surge in volume, confirming the strength of the downside move. This breakdown was followed by several key Market Equilibrium levels forming on the lower side:

- Market Equilibrium Down 1 @ 4896 – A crucial point signaling the continuation of the bearish momentum.

- Market Equilibrium Down 2 @ 4876 – Confirmed the downward pressure, with further downside potential.

- Market Equilibrium Down 3 @ 4856 – Another level of confirmation as price continued to fall, providing further opportunities for short trades.

On the upside, after the initial breakout, the market shifted direction and moved above the VC Zone, forming higher equilibrium levels:

- Market Equilibrium L 1 @ 4981 – The first significant equilibrium level after the price reclaimed the VC Zone.

- Market Equilibrium L 2 @ 5001 – Indicating continued buying strength with price advancing upward.

- Market Equilibrium L 3 @ 5051 – A key level confirming the bullish move as the market gained traction.

- Market Equilibrium L 4 @ 5101 – Another confirmation that the market was staying in the bullish range.

- Market Equilibrium L 5 @ 5151 – The final resistance area before a pullback, offering up to 180 points of upside profit.

Due to increased volatility, VIX levels were considered to determine the appropriate market equilibrium adjustments. Higher targets were maintained based on VIX readings, which helped guide the upward move and trailing the Market Equilibrium L levels.

Session Summary & Market Insights

✅ Price Reaction Down at 4906 Provided the First Short Trade Opportunity✅ Breakdown Below VC Zone with Strong Volume Triggered Continued Downtrend

✅ Market Equilibrium Levels L 1 to L 5 (Above VC Zone) Led to 180-Point Long Move

✅ Downside Breakdown Captured 30-Point Move with Continued Price Action Confirmation

✅ VIX Adjustments for Higher Targets & Trailing Equilibrium Levels Enhanced Trade Precision

The combination of Price Reactions, Market Equilibrium levels, and VC Zone analysis allowed traders to successfully capture both the downside and upside moves in the first 45 minutes of the session. The use of VIX levels further ensured that the higher market equilibrium levels were accurately adapted to manage volatility.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.