200 Points Move Captured in NIFTY_I with VC Zone & TR-Alert Concepts

Today’s session in NIFTY_I demonstrated how combining VC Zone and TR-Alert, two unique concepts of Bell Orderflow Ultimate, can map both downside and upside phases with remarkable clarity. By structuring the session into two phases, traders could systematically follow orderflow activity while managing risk through defined reference levels.

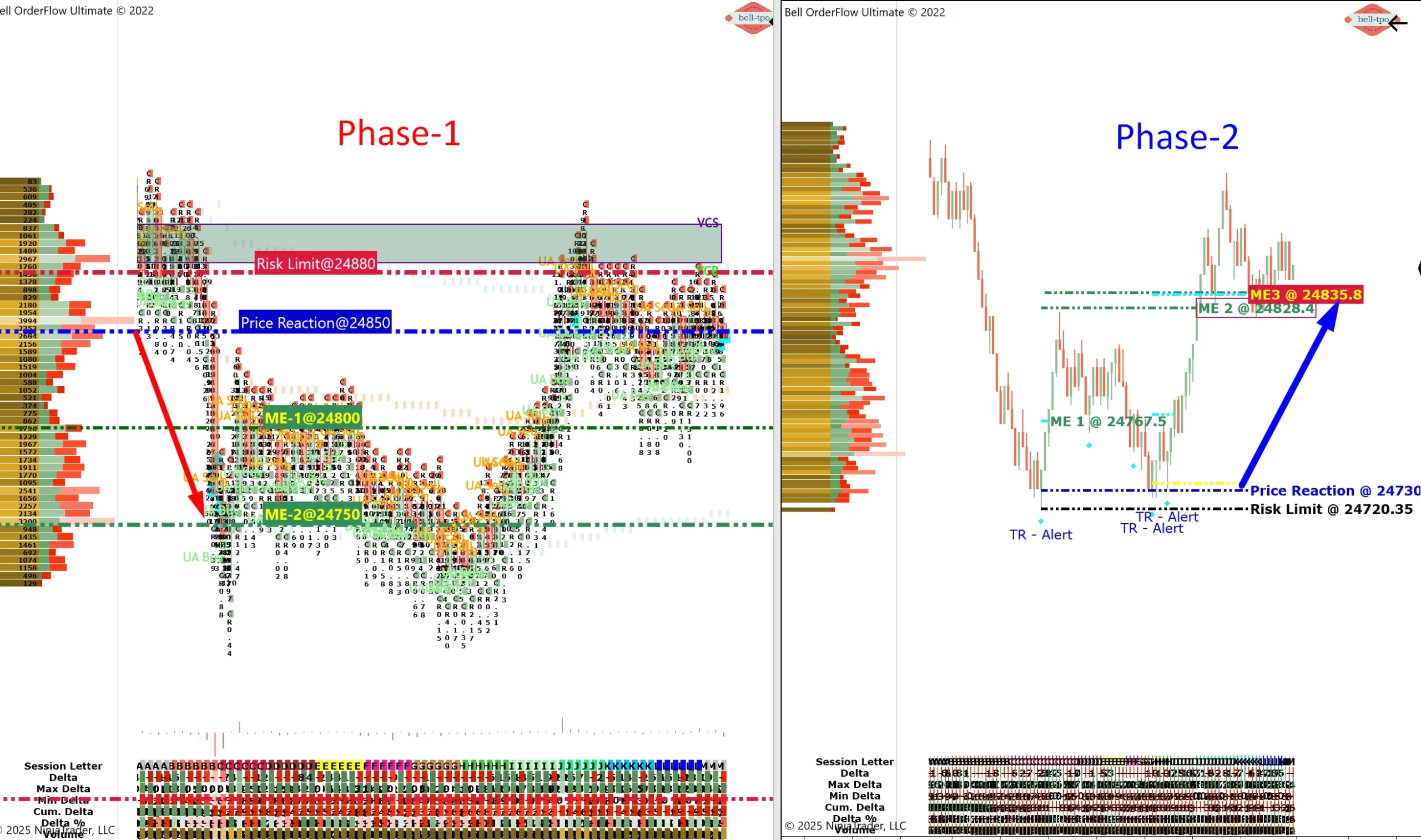

🔹 Phase 1 – VC Zone & UA Alert (Downside ~100 Points)

- Risk Limit @ 24880 Defined the boundary for downside control, helping to frame the trade within acceptable risk.

- Price Reaction @ 24850 Marked the point where the shift in momentum was first observed, confirming seller activity.

- ME-1 @ 24800 Signaled the first milestone, reinforcing the strength of the downside continuation.

- ME-2 @ 24750 Extended the structure and provided further confirmation of sustained pressure.

🔹 Phase 2 – TR-Alert (Upside ~100 Points)

- Risk Limit @ 24720.35 Offered downside protection while preparing for a reversal opportunity.

- Price Reaction @ 24730.4 Served as the key turning point where buyers took charge.

- ME-1 @ 24767.5 Validated the initial reversal momentum with a structured step higher.

- ME-2 @ 24828.4 Confirmed continuation strength and provided a target zone.

- ME-3 @ 24835.8 Marked the maturity of the move, showing trend stability.

🎓 Educational Insight

- This session reflects how Bell Orderflow Ultimate’s unique concepts — VC Zone and TR-Alert — complement each other. While VC Zones map high-activity clusters that drive structured downside phases, TR-Alerts capture orderflow-based reversals, enabling systematic tracking of upside moves.

- Together, they created a 200-point structured opportunity in NIFTY_I, showing how rule-based orderflow mapping provides clarity in both trending and reversing markets.

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.