200-Point Move Captured in NIFTY_I Using Bell Orderflow Ultimate

🔹 VC-Zone + Market Equilibrium Levels in Action

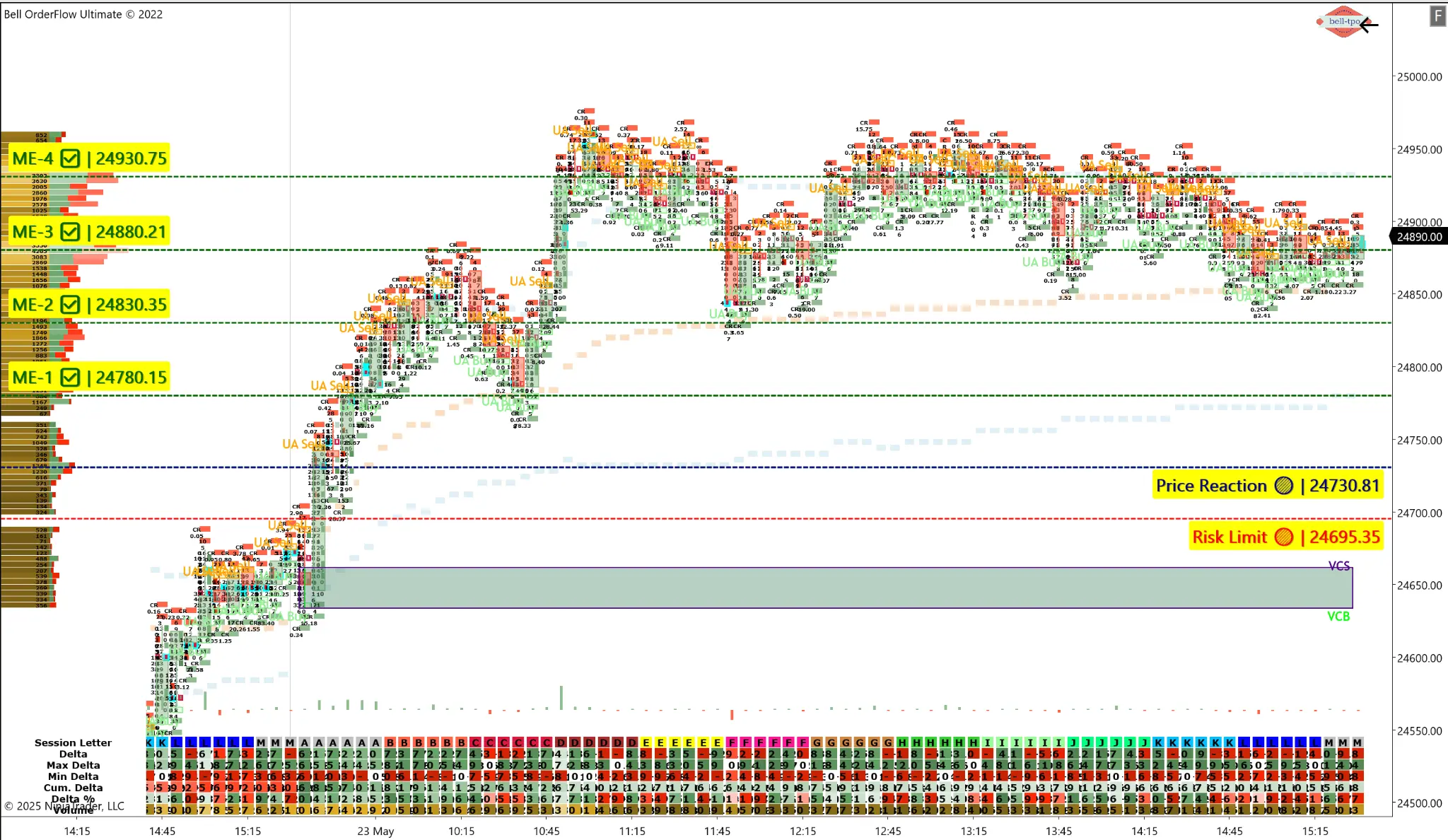

Today’s session in NIFTY_I offered a precise, structured opportunity captured using VC-Zone Alert from Bell Orderflow Ultimate. With a clear price reaction and logical progression through Market Equilibrium levels, the day unfolded as a classic example of how volume-based structure can guide traders.

🔍 Key Trade Flow: Session Summary

📍 Price Reaction @ 24730.81 – Initial reactive zone where buyers took control, paving the way for structured movement.

📌 Risk Limit held @ 24695.35 – This zone remained unviolated, validating the strength of VC-Zone context for intraday flow.

📈 ME-1 @ 24780.15 – First confirmation level, price respected and moved cleanly through. 📈 ME-2 @ 24830.35 – Orderflow supported further continuation. 📈 ME-3 @ 24880.21 – Momentum slowed but structure held firm. 📈 ME-4 @ 24930.75 – Final responsive zone where the session began to distribute. 📊 A structured 200-point move was captured within these defined levels — not through prediction, but by observingVC-Zone triggers, Price Reaction points, and ME logic.

💡 These are not trade signals — they are context zones designed to help traders frame risk and understand orderflow behavior.

🎯 Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit 👉 www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.