180-Point Structured Breakdown After 2nd Price Reaction – Powered by Bell Orderflow Ultimate

📉 180-Point Structured Breakdown After 2nd Price Reaction – Powered by Bell Orderflow Ultimate

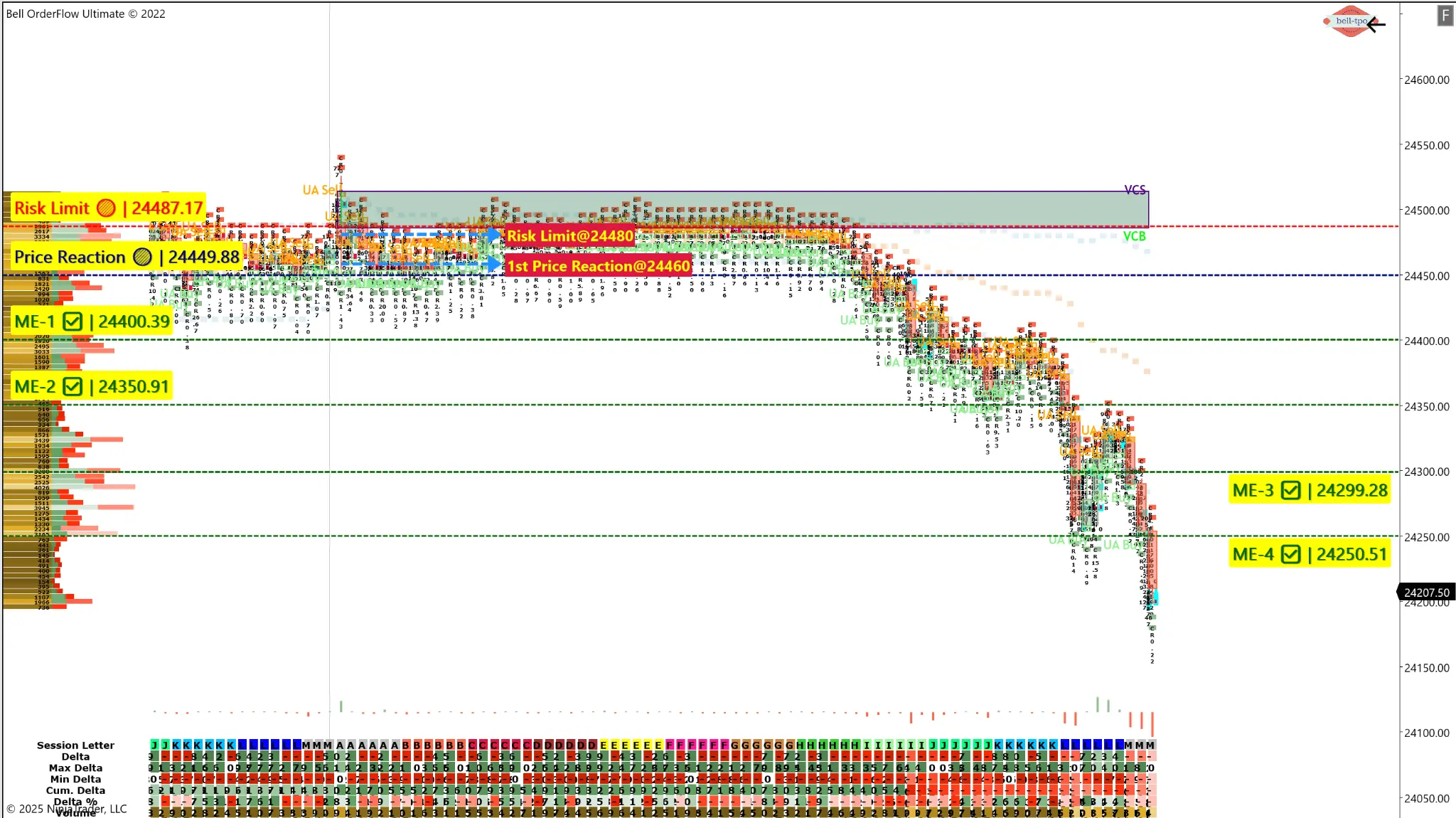

💡 From Early Risk to Full Trend Capture Using ME Logic & VC Zone RejectionToday’s session in [Instrument] offered a classic two-stage setup using Bell Orderflow Ultimate. While the first Price Reaction @ 24460 led to a controlled 20-point risk limit hit, the second Price Reaction @ 24449.88 delivered a clean and powerful 180-point move, guided by VC Zone rejection, TR-Short alerts, and a step-by-step breakdown across four Market Equilibrium levels.

This is a great example of how structured volume-based trading doesn’t end with one failed setup — it helps traders stay ready for the next high-probability opportunity.

🔍 Key Trade Flow:

🔴 1st Price Reaction @ 24460 – Risk Limit Hit☑️ The initial short entry failed as price moved above the Risk Limit @ 24487.17, resulting in a small 20-point stop hit.

📌 No emotional exit — the structure still pointed toward overhead resistance.

🟢 2nd Price Reaction @ 24449.88 – Trend Triggered💥 This became the real game-changer. The level showed fresh selling pressure with UA-Sell prints, TR-Short confirmation, and rejection from the VCB/VCS zone overhead — giving high-confidence to reinitiate short trades.

📌 Progressive Breakdown Across Market Equilibrium Levels

After the second Price Reaction, price declined cleanly — validating each Market Equilibrium zone as it moved:- ✅ Market Equilibrium 1 @ 24400.39 – 📉 First sign of structural weakness post-reaction; sellers took control.

- ✅ Market Equilibrium 2 @ 24350.91 – ⚠️ Downward pressure intensified with sustained selling interest.

- ✅ Market Equilibrium 3 @ 24299.28 – 🔽 Showed strong continuation behavior with initiative sellers dominating.

- ✅ Market Equilibrium 4 @ 24250.51 – 🔁 Attempted buyer absorption seen but failed to reverse — session low confirmed.

Each level offered a trail stop opportunity or a partial exit point, empowering traders to manage risk with confidence.

🧭 VC Zone (VCB/VCS) Rejection: Session Bias Sealed

The price opened below the VC Zone and failed to reclaim it, confirming that sellers had higher ground. This contextual rejection, when combined with Bell’s live alerts, strengthened the conviction to stay short — even after an initial loss.

📊 Session Summary:

🔸 1st Price Reaction @ 24460 – ❌ Risk Limit Hit (Loss of 20 points)🔸 2nd Price Reaction @ 24449.88 – ✅ Captured full move to ME-4

🔸 VC Zone Overhead acted as structural resistance

🔸 ✅ Clean breakdown through ME-1, ME-2, ME-3, and ME-4

🔸 📈 Net Captured Move: ~180 Points (Post initial controlled risk)

This is the kind of structured day-trading clarity that Bell Orderflow Ultimate was built for — not just signals, but meaningful, contextual levels that evolve with price and volume.

🚀 Maximize Your Trading Edge with Bell Orderflow Ultimate!

📊 Let structure guide your decision-making — with real-time VC Zones, Price Reactions, and Market Equilibrium logic.

🔹 Visit 👉 www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.