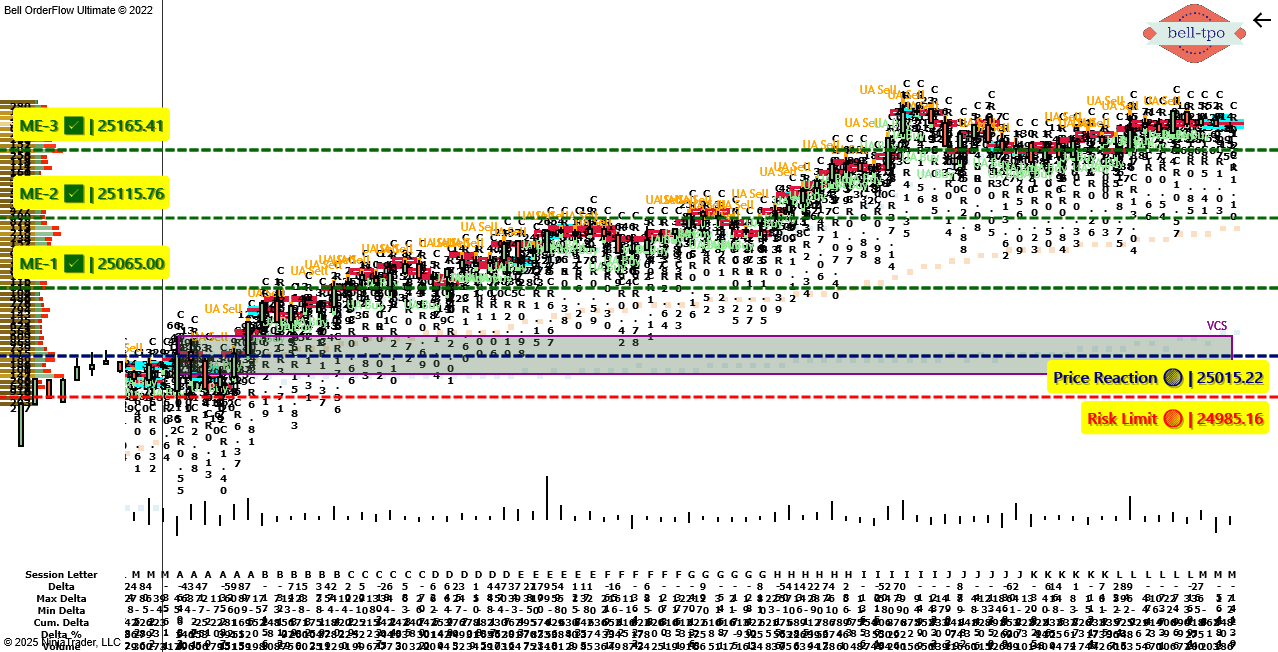

170-Point Structured Move in NIFTY_I Guided by VC Zone, CR, TBTS, UA Activity with Bell Orderflow Ultimate

Today’s NIFTY_I session demonstrated how Bell Orderflow Ultimate’s concepts-driven framework transforms complex market flow into a clear, actionable roadmap. By integrating VC Zone, Cot Ratio (CR), TBTS (Trapped Buyers & Sellers), and UA Activity Concepts, traders were guided through a well-structured 170-point upside move.

Session Highlights with concepts at the Core

The day began with a decisive Price Reaction @ 25015.22, confirming early buyer strength and setting the long-side bias. The Risk Limit @ 24985.16 provided a defined boundary, ensuring focus remained on the upside as long as this level held.

Key progress was marked through equilibrium shifts at:

- ME-1 @ 25065 → Marked the initial shift in market equilibrium, confirming that buyers were taking control after the Price Reaction. It provided the first key checkpoint for sustaining the upward momentum.

- ME-2 @ 25115.76 → Indicated continuation strength in the auction flow, showing that buyers maintained control beyond the initial breakout. This reinforced confidence to stay aligned with the trend.

- ME-3 @ 25165.41 → Represented the higher equilibrium stage, signaling the culmination of the session’s structured move. It reflected the final phase of buyer dominance in this rally.

Power of Concepts in Structured Moves

- VC Zone Concepts → Identified the core value area where market control transitioned decisively to buyers.

- Cot Ratio (CR) Concepts → Validated the strength of auction reactions, helping traders trust the directional conviction.

- TBTS Concepts → Revealed trapped sellers, showing how their exits fueled further upside momentum.

- UA Activity Concepts → Highlighted unfinished auction areas, indicating ongoing market participation and avoiding premature exits.

- These Concepts combined with structural references to provide clarity, discipline, and confidence in managing trades during the rally.

Net Outcome

By staying aligned with Concepts and structural checkpoints, traders could confidently follow the market’s flow and capture a 170-point upside move in NIFTY_I.

Conclusion

Today’s session reinforced that alert-driven orderflow insights combined with core structural references like Price Reaction, Risk Limit, and ME Levels can guide traders through dynamic market conditions. With VC Zone, Cot Ratio, TBTS, and UA Activity Concepts, traders can replace guesswork with an objective, data-driven approach, making decisions with clarity and discipline.

✅ Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com to explore how our alert-focused framework delivers structure and confidence to professional traders.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. It is not investment advice or a buy/sell recommendation. Trading in the securities market involves risks; users should conduct their own research or consult a SEBI-registered financial advisor before making trading or investment decisions. Past performance is not indicative of future results.