150 Points Move Captured in NIFTY_I Using TBTS & VC Zone Alerts

A Net Gain of 140 Points Achieved with Bell OrderFlow Ultimate

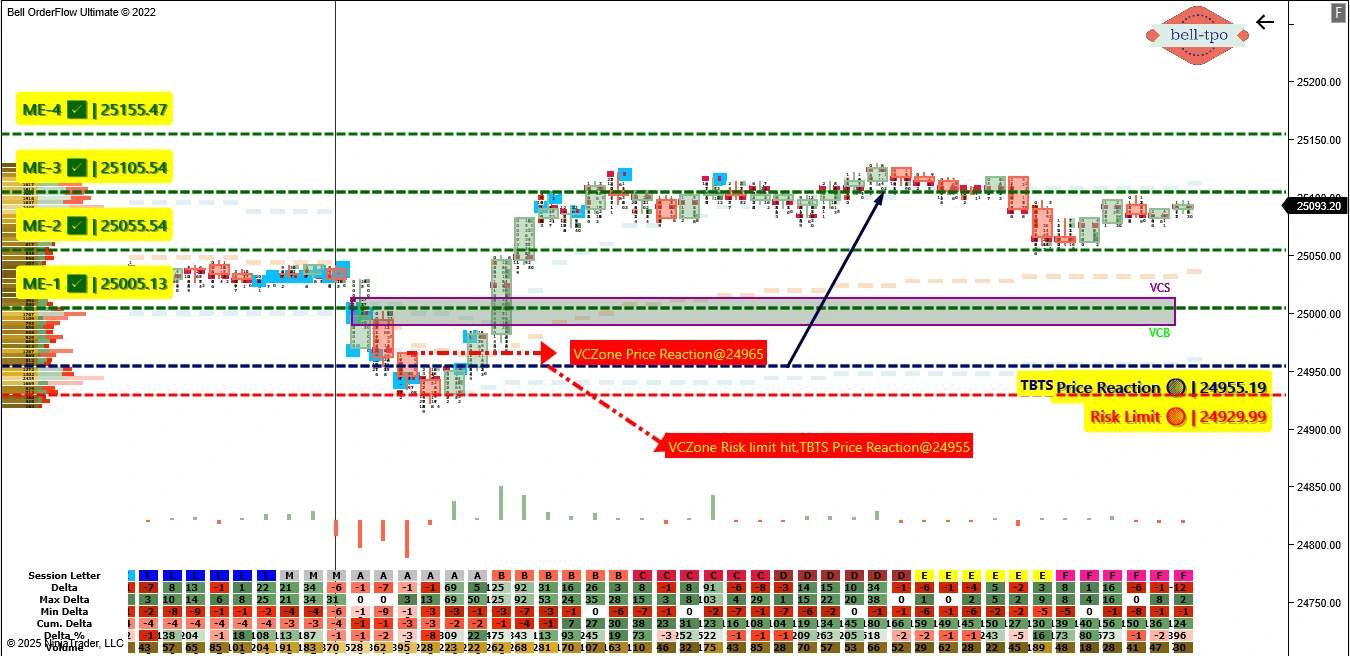

Today’s session showcased a powerful confluence between the VC Zone and TBTS alert framework within Bell OrderFlow Ultimate, demonstrating how systematic observation of reaction levels can help traders stay aligned with market transitions.

📉 Phase 1 – VC Zone Price Reaction Triggers Initial Down Move

- The session began with a visible VCZone Price Reaction at 24965, indicating potential downward momentum.

- However, this move encountered a TBTS Price Reaction at 24955, which not only absorbed the downside but also triggered a shift in market sentiment.

- The VCZone Risk Limit was breached, suggesting a reevaluation of directional bias was warranted.

📈 Phase 2 – Long-Side Continuation with Structural Follow-through

- The TBTS Price Reaction at 24955 acted as a strong inflection point where sellers failed to push further, leading to a directional shift.

- This level served as a launchpad for the upside move and reinforced the breakout strength from the earlier VC structure.

- ME-1 completed at 25005.13 This marked the first checkpoint validating the bullish breakout structure. Price consolidating above this level signaled continued demand flow.

- ME-2 completed at 25055.54 A clean response at this level showed strong acceptance in the new price zone. The order flow remained constructive, affirming higher intentions.

- ME-3 completed at 25105.54 This final target in the session confirmed a well-structured move. It validated the strength of the phase-2 rally after the TBTS trigger.

🔍 Key Technical Highlights

- The TBTS Price Reaction level at 24955.19 was the turning point.

- The zone breakout from the VCB (Volume Cluster Base) further supported the directional momentum.

- Market reaction at each ME level validated the progressive strength of the move, allowing 150 points to be captured from reversal to peak.

✅ Conclusion

Bell OrderFlow Ultimate once again illustrated its precision in identifying market transitions. With the dynamic interaction between TBTS Alerts and VC Zone structure, today’s session delivered a total of 150 points movement, resulting in a net gain of 140 points after accounting for initial reversals.

This highlights the importance of combining structured reference zones with real-time order flow signals to anticipate price behavior.As always, these observations are shared strictly for educational and analytical purposes within the BellTPO ecosystem.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.