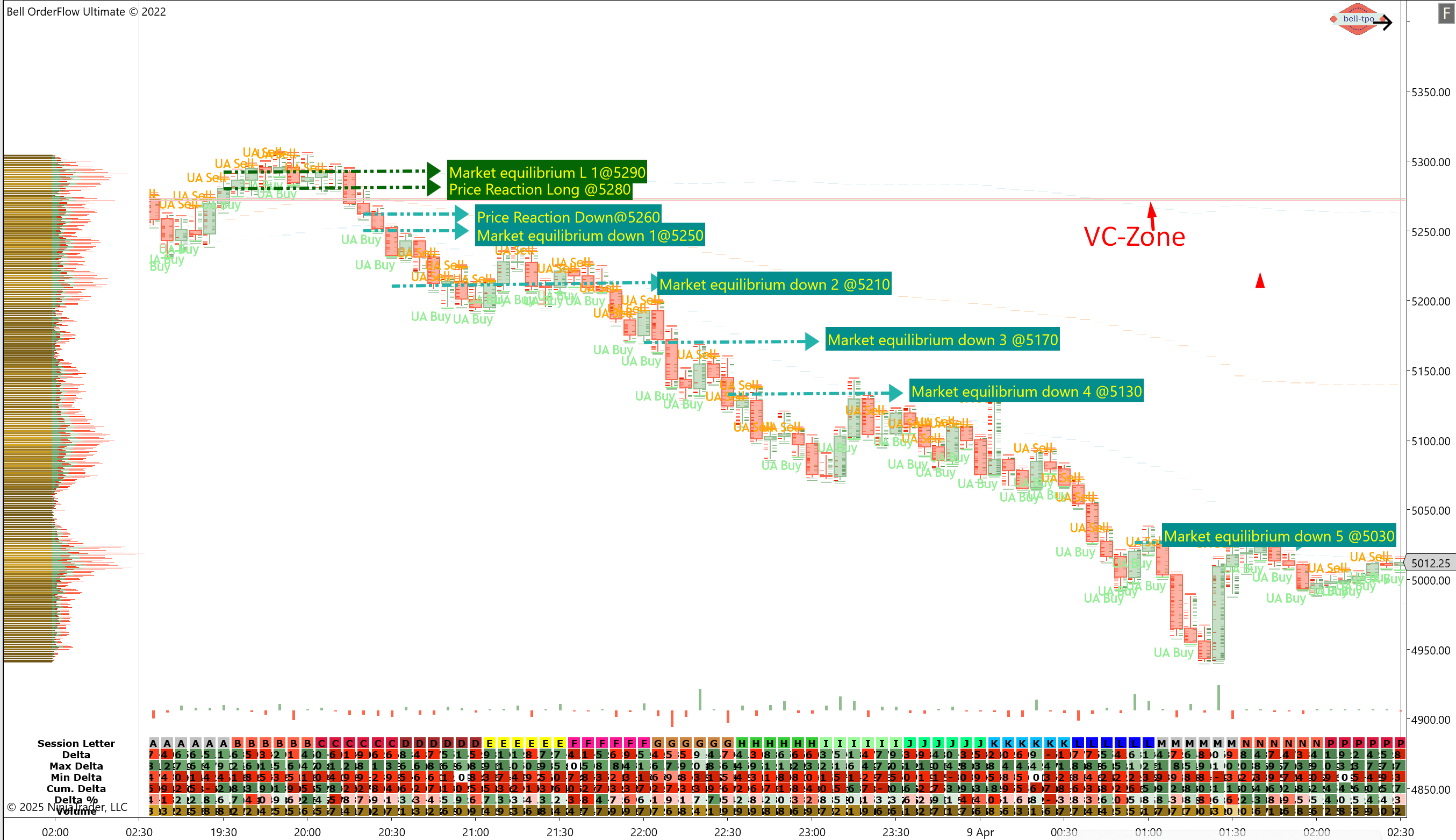

150-Point Market Move: Price Reaction, VIX & VC Zone Alert in ESJUN25 – April 8th, 2025

April 8th, 2025, proved to be another action-packed session in ESJUN25, with a clean 150-point move within the first two hours of trading. Both downside and upside opportunities were clearly visible, with Price Reactions and Market Equilibrium levels guiding the trades. As usual, Bell Orderflow Ultimate provided the clarity needed to capture these moves, aided by volume-based price analysis and precise management of the VC Zone.

Key Market Developments & Observations

📌 Price Reaction Long @ 5280 The session began with a notable Price Reaction Long @ 5280, marking a clear bullish setup. This price reaction offered a quick move to the upside, setting the stage for a continued bullish trend. 📌 Market Equilibrium Levels on the UpsideAs the market pushed higher, several Market Equilibrium levels formed, offering clear targets for long trades:

- Market Equilibrium L 1 @ 5290 – The first key level of support that helped push the market higher.

- Market Equilibrium L 2 @ 5300 – Indicating that the market was maintaining strength as it moved further up.

- Market Equilibrium L 3 @ 5310 – Confirmed the bullish trend, further supporting the upside move.

- Market Equilibrium L 4 @ 5320 – Continued confirmation of the bullish move as the market gained traction.

- Market Equilibrium L 5 @ 5330 – Final confirmation before a pullback, giving traders a substantial gain from the initial long reaction.

The market then transitioned to the downside, where a Price Reaction Down @ 5260 triggered a sell-off. This shift provided opportunities for short trades, and the market sliced through multiple downside equilibrium levels:

- Market Equilibrium Down 1 @ 5250 – A clear sign of continuing bearish pressure.

- Market Equilibrium Down 2 @ 5210 – Confirmed the strength of the bearish move.

- Market Equilibrium Down 3 @ 5170 – A key confirmation point as the market continued its descent.

- Market Equilibrium Down 4 @ 5130 – Reinforced the downtrend, providing further opportunities to capture the downward move.

- Market Equilibrium Down 5 @ 5030 – The final downside level before the market showed signs of stabilizing.

The VC Zone provided an important reference point during the session. As the market tested the upper and lower ranges of the VC Zone, it helped confirm both the bullish and bearish reactions. The price was contained within the VC Zone until a breakout below occurred, signaling the shift to the downside.

Session Summary & Market Insights

✅ Price Reaction Long at 5280 Provided Initial Upside Move✅ Market Equilibrium Levels on the Upside Led to 150-Point Gain

✅ Downside Breakdown Below VC Zone Triggered Continued Bearish Pressure

✅ Multiple Market Equilibrium Down Levels Offered Further Short Trade Opportunities

✅ VC Zone Played a Key Role in Defining Market Boundaries and Reactions

This session on April 8th, 2025, demonstrated the power of Bell Orderflow Ultimate in helping traders identify both upside and downside opportunities. Through the careful observation of Price Reactions, Market Equilibrium levels, and the VC Zone, traders were able to capture significant movements on both sides within a short time frame.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.