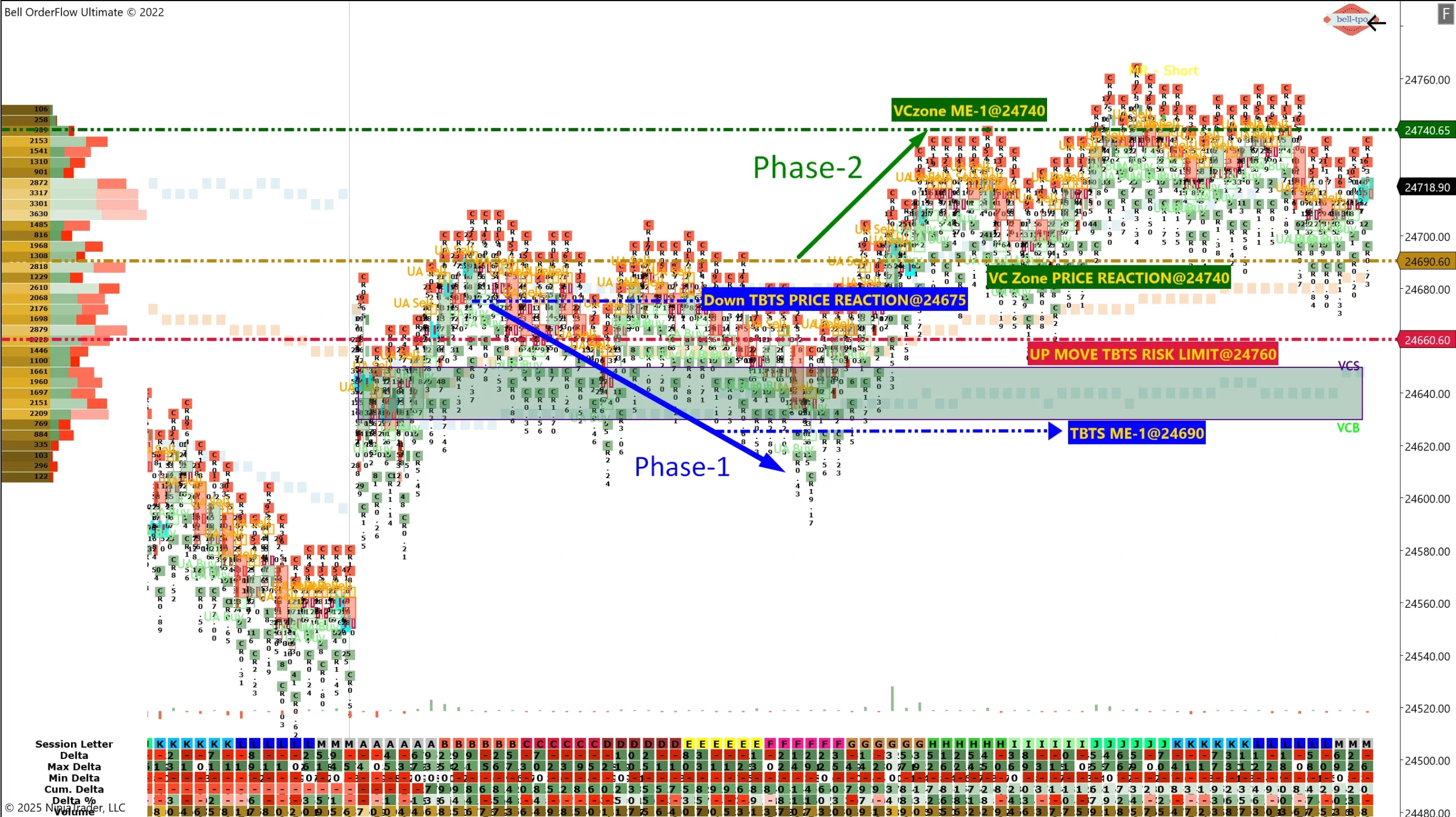

100 Points Structured Move in NIFTY_I with Bell Orderflow Ultimate

Today’s market structure unfolded in two distinct phases, each providing a 50-point opportunity. The initial move emerged from a TBTS down alert, followed by a reversal confirmed through the VC Zone.

Phase 1 – Down Move (50 Points)

- TBTS Price Reaction @ 24675: The market reacted precisely at the TBTS down level, initiating a controlled downside move.

- TBTS ME-1 @ 24690: Served as the milestone marker, enabling traders to manage risk while capturing the structured decline.

Phase 2 – Long Move (50 Points)

- VC Zone Price Reaction @ 24740: The VC Zone acted as a strong reference, triggering the upside move.

- VC Zone ME-1 @ 24740: Marked the continuation point, allowing the structured rally to complete its objective.

Risk Management Reference

- VC Zone Risk Limit @ 24760: Provided a predefined threshold for controlling adverse movement during the second phase.

Conclusion

By combining Bell Orderflow Ultimate’s TBTS alerts with VC Zone levels, today’s session allowed traders to participate in both a downside and an upside move effectively. This approach reinforces the importance of structured execution and disciplined risk control, enabling consistent results across different market phases.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.