100 Points Structured Move Captured with Bell OrderFlow Ultimate

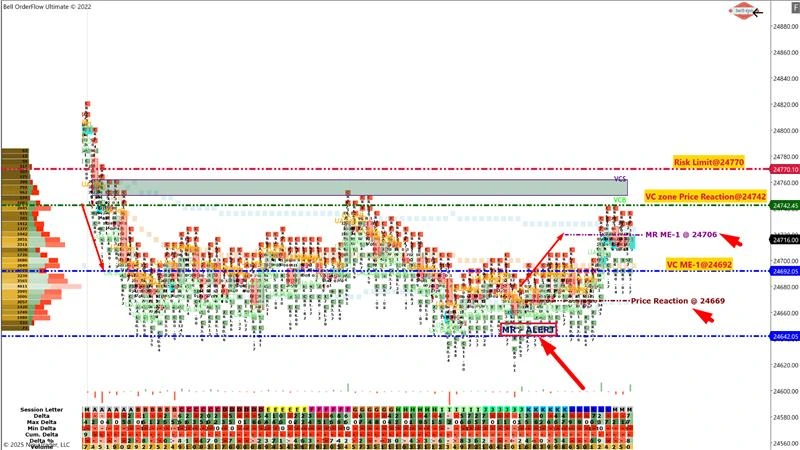

Today’s NIFTY_I session showcased how VC Zones, MR Alerts, and TBTS confirmations can work together to provide structured trade setups and clear setup confirmations.

Phase 1 – Short Setup Observation

The session began with a short-side setup forming inside the VC Zone:

- VC ME-1: 24,692 – The first measured extension from the VC Zone, providing a reference for potential continuation or reversal points.

- VC Zone Price Reaction: 24,742 – A key reaction area used to observe price acceptance or rejection.

- Risk Limit: 24,770

Price respected the Risk Limit before directional intent shifted.

Phase 2 – Long Setup Observation

The bias turned to the long side, with setup Observation coming from TBTS, MR, and UA patterns (UABUY/UASELL sequence):

- MR Price Reaction: 24,669 – Indicates where strong market participation emerges through significant order flow activity.

- MR ME-1: 24,706 – The first measured extension within the MR context, highlighting potential continuation areas.

This confluence of tools offered a structured long-side opportunity.

Conclusion:

From Phase 1 to Phase 2, the market delivered a net 100-point structured move in NIFTY_I, validated through setup confirmation and precise reaction levels.

Maximize Your Trading Edge with Bell Orderflow UltimateVisit www.belltpo.com or reach out to us for more details.

🚨 Disclaimer: We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.