100-Point Structured Move Captured in NIFTY_I Using Bell Orderflow Ultimate

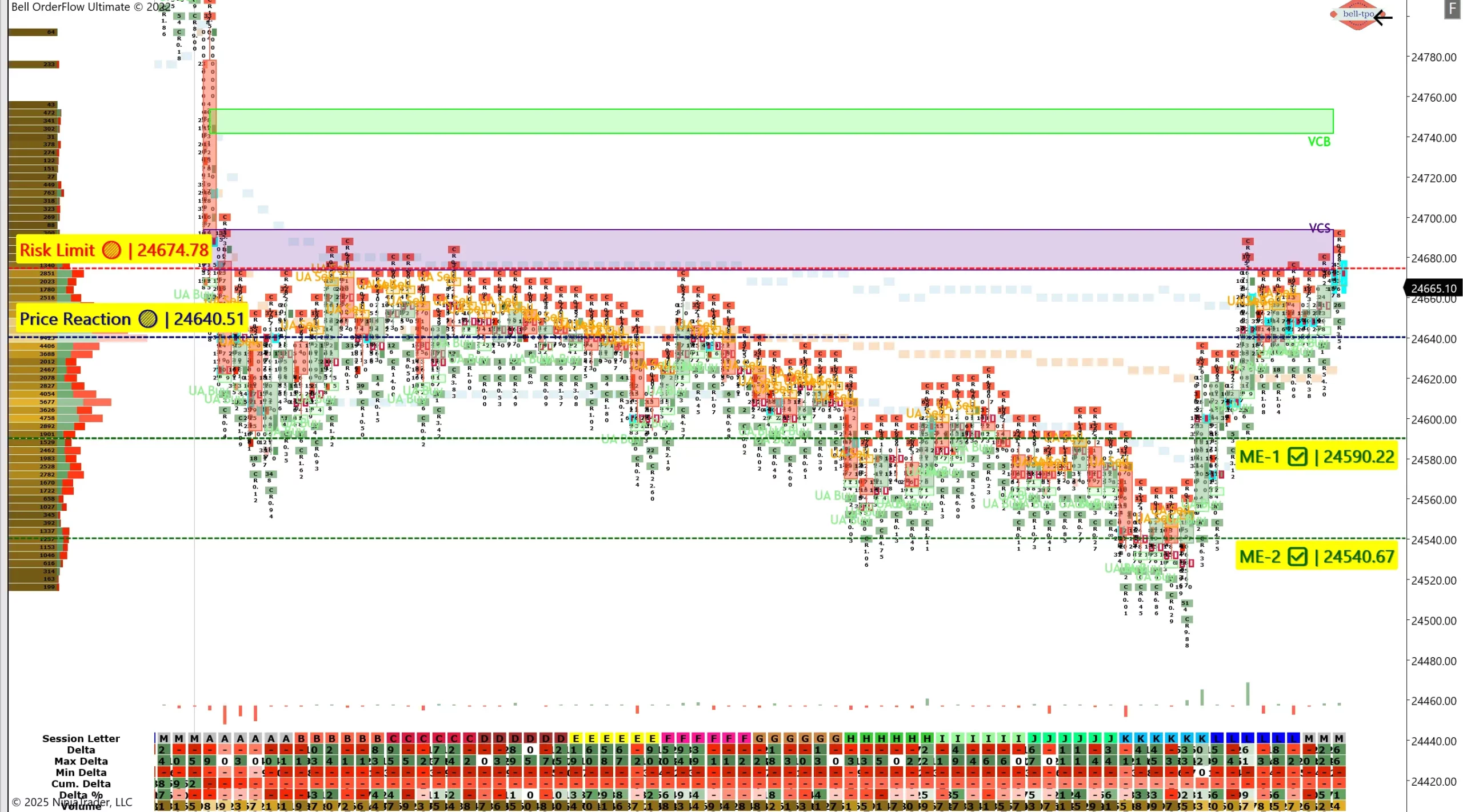

🔍 Today’s session showcased the precision of Bell Orderflow Ultimate, with a clearly defined VC-Zone alert enabling a 100-point move in NIFTY_I — 50 points captured within the first 45 minutes, followed by an additional 50-point rally later in the day.

🔹 Early Price Reaction & Risk Management

- 🟡 Price Reaction @ 24640.51: This level acted as the first structural pullback zone after the market dipped from the opening range. Buyers stepped in, leading to a clean upside reaction.

- 🔴 Risk Limit @ 24674.78: This was the upper boundary of the VC-Zone, signaling caution for long trades if breached without confirmation.

The initial 50-point move was captured from Price Reaction to just below the Risk Limit, aligning with volume cluster support and real-time delta absorption zones.

🔹 Market Equilibrium Zones Confirm Directional Bias

- 🟢 ME-1 @ 24590.22: The market respected this equilibrium zone during consolidation, confirming buyer strength.

- 🟢 ME-2 @ 24540.67: Served as the structural base from which the final rally launched after UA Alert confirmations.

As the market retested ME-2 and formed a series of UA Buys and TPO absorptions, the second leg of the up-move delivered another 50-point gain, validating the Bell Orderflow Ultimate model’s predictive logic.

🔄 VC-Zone: The Core Signal Engine

The VC-Zone (Volume Control Zone) mapped the high-probability reversal band, where the confluence of:- UA Alert clusters (Unfinished Auctions)

- seller strength near ME zones

- Structural POC holding patterns …allowed traders to frame their setups with conviction.

📌 The second price action emerged right from ME-2 and traversed all the way through ME-1 to the VC-Zone boundary, respecting each level with precision.

🧠 Key Observations

- Orderflow concepts like UA Buy clusters, delta shift, and price stalling below the Risk Limit were instrumental in filtering out noise.

- Bell Orderflow Ultimate alerts gave structured the decision-making based on volume-based logic and ME anchoring.

- Both legs of the 100-point move were conceptually driven, showing how visual zones like Price Reaction, Risk Limit, and ME Levels form a robust framework for intraday traders.

- ✅ First Leg: 50 points captured from Price Reaction to VC-Zone high within first 45 mins

- ✅ Second Leg: 50 points captured on reversal from ME-2 to ME-1 zone and above

- 🎯 Total Structured Move: 100 Points in NIFTY_I

🔗 Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit 👉 www.belltpo.com or reach out to us for more details.

🚨 Disclaimer:

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.