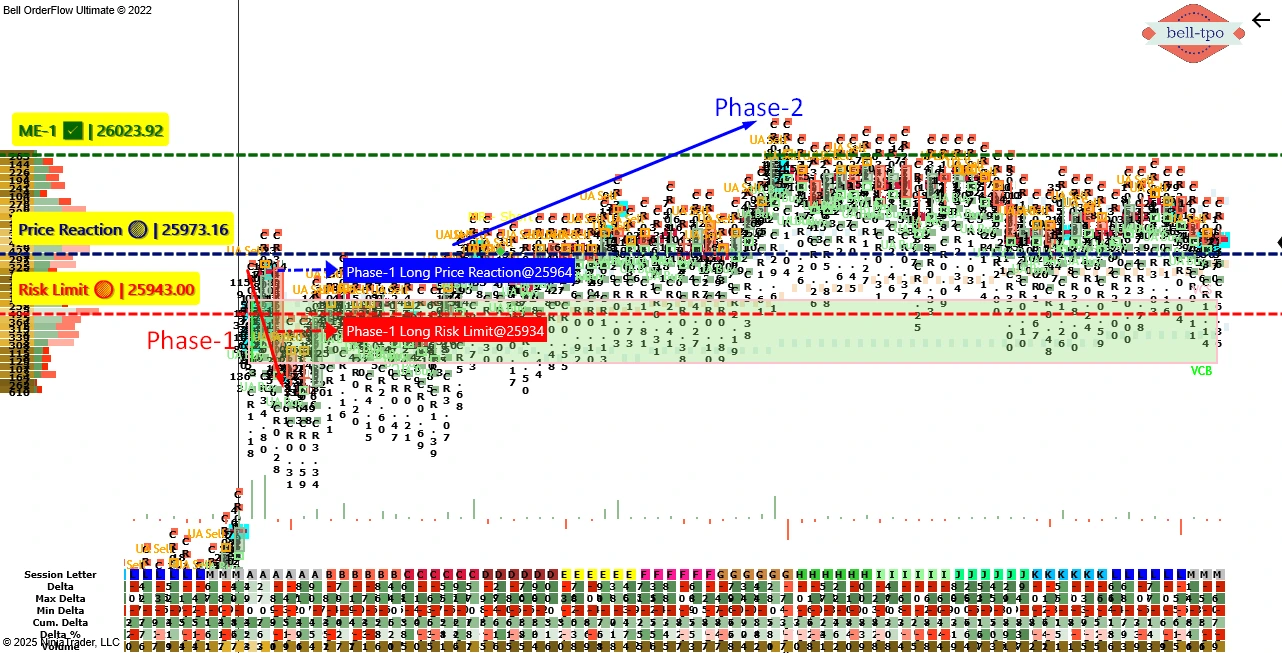

Educational Takeaway: Net 20 Points Move Captured in NIFTY_I with VC Zone + TBTS + UA + CR using Bell Orderflow Ultimate

The session showcased a balanced structure with controlled volatility. Bell Orderflow Ultimate helped identify precise price reaction zones and risk limits that defined the day’s directional bias. Both phases provided a clear example of how structured execution within the VC Zone and ME levels ensures disciplined trading outcomes.

Phase-1: 30 Points Risk Limit Hit

Price Reaction:

The initial long setup triggered near Price Reaction @25964, indicating early buying interest aligned with the VC Zone structure. Despite strong initiation, orderflow absorption suggested limited follow-through, hinting at potential exhaustion.

Risk Limit:

Risk Limit @25934 was the defensive zone for this setup, defining the threshold for invalidation. The breach confirmed a short-term imbalance, concluding Phase-1 with a 30-point controlled stop.

ME Levels:

ME levels were not active in this early phase as the reaction remained within consolidation. Focus shifted to the next structural response for a fresh directional setup.

Phase-2: 50 Points Long Move Captured

Price Reaction:

The fresh upward momentum began at Price Reaction @25973.16, with clear confirmation from the UA and CR alignment. Buyers regained control, validating the earlier failed attempt and pushing prices back above equilibrium.

Risk Limit:

Risk Limit @25943 defined the risk boundary for this long setup, ensuring a disciplined re-entry with limited downside. Price action respected this level throughout the phase, reinforcing strong control from buyers.

ME Levels:

ME-1 @26023.92 acted as the measured objective, aligning perfectly with exhaustion prints at the upper boundary. The reaction near ME-1 validated Bell Orderflow Ultimate’s precision in projecting achievable intraday extensions.

Conclusion

The session illustrated how Bell Orderflow Ultimate efficiently aligns market structure with volume confirmation through VC, TBTS, and UA alerts. By adhering to predefined risk limits and reaction zones, traders can observe disciplined execution and avoid impulsive decision-making.

This approach highlights the importance of structure-based trading — focusing on context and orderflow validation, rather than prediction. Such analysis helps traders understand intraday behavior, manage exposure effectively, and enhance consistency within a rules-based framework.

Maximize Your Trading Edge with Bell Orderflow Ultimate

Visit www.belltpo.com or reach out to us for more details.

Disclaimer

We are a software and indicator development company. This chart and analysis are for educational and informational purposes only. This is not investment advice or a recommendation to buy, sell, or trade any financial instrument. Users must conduct their own research before making any trading decisions. Past performance is not indicative of future results.